- Bitcoin price breaks $117K resistance, eyeing $120K and $124K as next key levels for potential gains.

- Bitcoin price breakout above $117K signals possible continuation towards $120K and $124K resistance zones.

- With Bitcoin price above $117K, traders are watching volume and momentum to confirm if the bullish trend will sustain.

Bitcoin price has just broken through the $117,500 resistance level, causing much attention in the market. With Bitcoin surging more people are asking questions on whether this breakout is set to bring in more profits or whether the cryptocurrency will hit new challenges in future. Analysts and traders are keeping a close eye on the Bitcoin price path ahead, with support and resistance zones on the weekly horizon.

Bitcoin Price Breakout Above $117K Resistance

Bitcoin price smashed the bullish resistance at $117,500, a crucial phase in the latest bull rally. The breakout accompanied a consolidation period, where Bitcoin was trading in a relative small range.

According to analysts, IncomeSharks, the breakout is a big step, and Bitcoin may seek new levels of resistance, especially at around $120,000 and $124,000. These levels will play a critical role in establishing whether Bitcoin price could maintain the bullish trend.

Source: IncomeSharks/X

With the new levels of Bitcoin price, it is critical to look at the amount used and the mood in the market. In the case of the price behavior increasing the volume, it may indicate the good current activity and future movement of the rise in the graph. But an absence of volume may be an indication of momentum loss

Market Sentiment and Indicators for Bitcoin Price

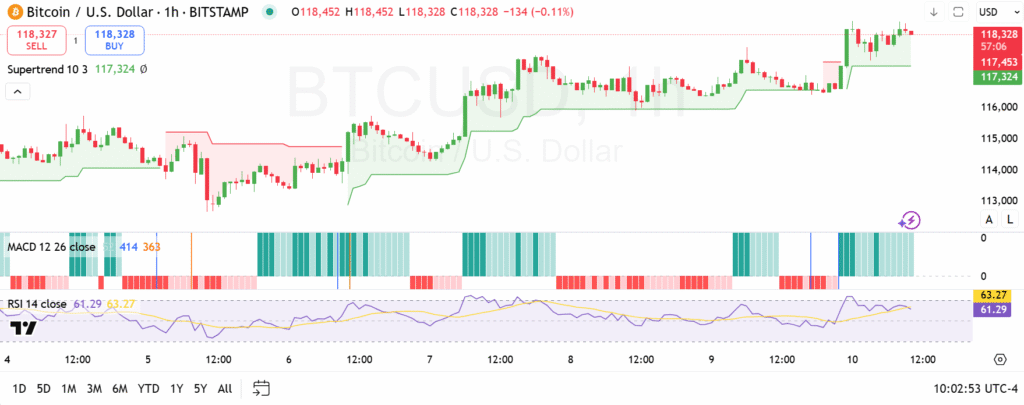

The sentiment in the market with regard to the Bitcoin price is bullish with a great deal of sentiment in the market after the recent breakout. Nevertheless, traders are advised to pay attention to such important technical indicators like Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) that can help make a conclusion about the power of the ongoing bullish movement.

Source: TradingView

However, when the price of Bitcoin price goes into overbought conditions, which is represented by an RSI value over 70, then it can indicate that the market is approaching an overheated state. In this situation, there is a possibility of a pull back in Bitcoin after which it may rise again.

Observing these indicators and action of price will play a major role in helping discern whether Bitcoin price is poised towards any further upside or whether a reversal is a possibility.

Read Also: