- XRP is consolidating around the level of 3.08 with 4-hour RSI gains; this is indicative of a possible breakout that could lead to a sharp rise in price.

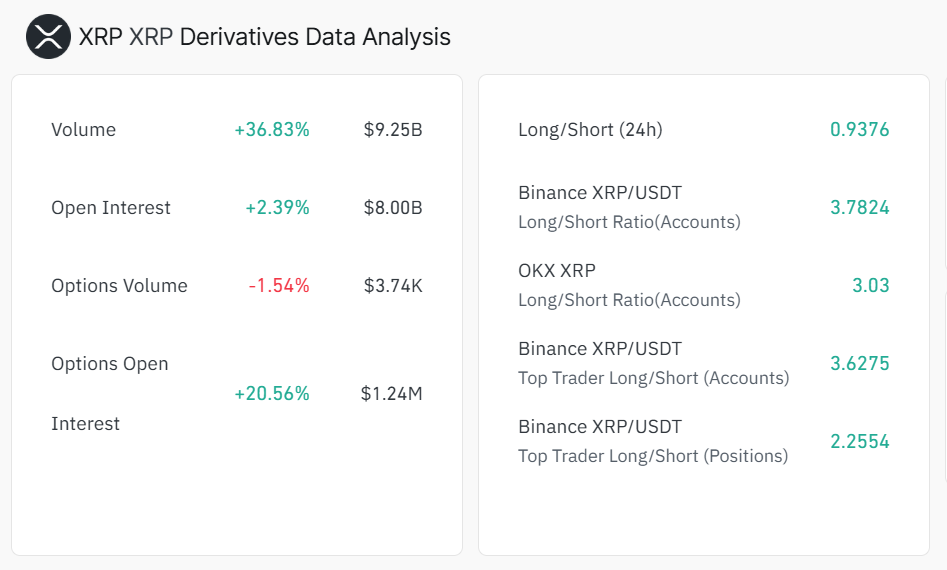

- The volume of XRP derivatives trading increased to $9.25 billion, and open interest was on the rise, indicating the increasing activity and interest of traders in the market as the market awaited a breakout.

- Long positions are by far more popular with the top traders on Binance and OKX and reflect a concentrated bullish outlook and precondition the price boom.

XRP is holding a tight consolidation pattern, approaching a potential breakout point at $3.08. Price action is compressing near the apex, signaling increased market attention. The 4-hour RSI shows bullish strength, pointing toward possible upward momentum.

Consolidation Pattern and Key Levels

XRP recently tested the bottom trendline of its consolidation and reacted strongly, moving toward the upper boundary. According to CasiTrades, the apex of this pattern aligns with the .382 support at $2.99, forming a critical level traders are monitoring.

Breaking above $3.08, followed by a backtest as support, would confirm the continuation of the bullish trend. The coiling of price suggests that the market is storing energy within this consolidation. The tightening price range increases the probability of a decisive move in the near term.

No new lows were recorded during the latest tests, keeping macro extensions valid. The support retention and aggressive RSI on the 4-hour chart show the technical basis of the possibility of a breakout above $3.08. The market seems to be ready for a significant movement once the movement changes.

Trading Volume and Open Interest Trends

XRP derivative volume surged to \$9.25 billion, an increase of 36.83 percent in 24 hours. This is indicative of an increased level of trading, with the investors anticipating potential price movement. The increase in volume indicates that the traders are positioning in anticipation of a breakout.

Open interest also increased modestly to $8.00 billion, indicating that market participants are holding longer-term positions. This sustained commitment shows confidence in XRP’s consolidation pattern. Options data also reflect accumulation, with open interest rising 20.56% despite a slight decline in volume, signaling hedging and strategic positioning.

The combination of high trading volume and rising open interest points to increasing market engagement. Traders appear ready to act if XRP decisively breaks above the $3.08 resistance level.

Market Sentiment and Top Trader Activity

The long-to-short ratio of 24 hours is 0.9376 with a weak bearish lean on the part of retail traders. While shorts slightly exceed longs, the sentiment remains balanced and limited in scope.

Top trader data show strong bullish positioning. On Binance, account ratios reach 3.7824, and top trader positions indicate 2.2554. OKX data also shows 3.03, highlighting that experienced traders favor long positions. CasiTrades emphasizes that top traders are overwhelmingly bullish, suggesting potential momentum in price.

The increased RSI momentum and accumulation in the derivatives markets predetermine the potential breakout. In case XRP exceeds $3.08 and maintains the position as support, the market may reflect an upward trend, with the bullish force and involvement of the market.