- SEI forms a falling wedge on the 4-hour chart, with Fibonacci levels pointing toward a potential breakout rally targeting the $0.34 region.

- Derivatives data show surging SEI trading volume, declining open interest, and Binance traders leaning long, signaling stronger confidence in near-term upward momentum.

- 21Shares files for a spot SEI ETF with Coinbase custody, following Canary Capital’s earlier filing, showing rising institutional demand for exposure.

SEI is showing signs of a potential breakout as technical patterns and market data suggest growing momentum toward a possible 16% price surge.

Falling Wedge Structure Near Breakout Levels

Crypto analyst Ali observed that SEI is forming a falling wedge on the 4-hour chart, a bullish formation often signaling a reversal. At present, the token trades at $0.2884, just under the 0.786 Fibonacci retracement level of $0.2901, which acts as immediate resistance.

A breakout above the wedge’s upper boundary could trigger bullish acceleration. Fibonacci projections identify upside levels at $0.3033 (0.618), $0.3130 (0.5), and $0.3230 (0.382). Should momentum continue, the price could reach $0.3356, in line with the wedge’s measured target of a 16% advance toward $0.34.

Support is positioned at $0.2740, which also aligns with the 1 Fibonacci extension level. Failure to hold this zone could weaken the bullish setup. However, compressed price action and possible bullish divergence suggest probabilities remain tilted toward an upward move.

Trading Activity and Derivatives Positioning

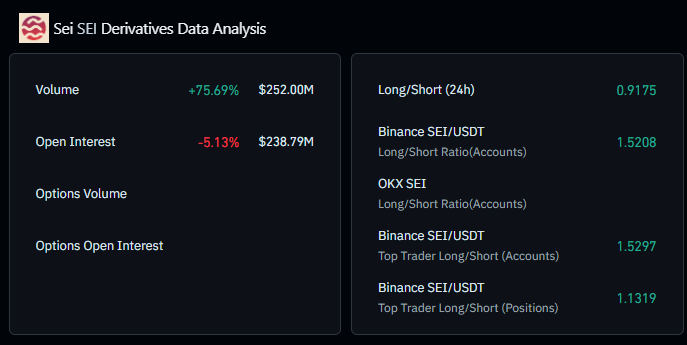

Derivatives data indicate increasing market activity around SEI. Trading volume surged 75.69% to $252 million, reflecting heightened participation. However, open interest slipped 5.13% to $238.79 million, signaling that traders closed positions instead of adding new exposure.

The 24-hour long/short ratio stands at 0.9175, suggesting mild short-term bearish positioning. However, Binance traders are leaning bullish, with long-to-short ratios at 1.5208 for accounts and 1.5297 for top traders. Additional positioning data also favor longs at 1.1319, reinforcing expectations of potential upside.

On OKX, traders remain more cautious, showing less aggressive long exposure compared to Binance participants. Despite differences between platforms, overall sentiment skews bullish. SEI currently trades at $0.2789, with daily volume at $130.39 million, keeping it in active focus across exchanges.

ETF Filings Add Institutional Interest to SEI

Institutional demand is beginning to form around SEI. A report from Sei Intern (@seiintern_) confirmed that 21Shares has filed an S-1 with the U.S. Securities and Exchange Commission for a spot SEI ETF. Custody will be managed by Coinbase, and the structure may incorporate staking rewards.

This filing follows an earlier move by Canary Capital, which submitted documentation for a Staked SEI ETF. The two filings, arriving within a short period, point to growing interest in structured investment products tied to SEI. Approval processes remain pending, but the activity indicates that the token is drawing attention from asset managers.

ETF structures can provide investors with exposure to SEI without managing the underlying asset directly. The potential inclusion of staking rewards could also appeal to those seeking yield. These institutional moves arrive as SEI positions itself within a bullish technical setup, creating added interest in its next market direction.