- Shiba Inu retested its breakout structure, confirming stability and technical strength, setting the stage for a potential major upward movement.

- The MACD histogram shows regular bullish divergence, indicating fading bearish pressure and signaling momentum could drive SHIB toward significant gains.

- Rising open interest and long positions across Binance and OKX suggest trader accumulation, supporting SHIB’s potential for continued upward momentum.

Shiba Inu (SHIB) appears to be establishing a massive bullish recovery following an extended descending pattern. The technical indicators are suggesting that the cryptocurrency could have a massive upward movement in the coming months.

Technical Patterns Signal Potential Breakout

Shiba Inu recently retested its previous structure, maintaining stability above the breakout level. This confirms that the cryptocurrency has established structural strength after years of correction since its 2021 peak. Traders view this as a critical setup for upward movement.

The MACD histogram is forming a regular bullish divergence, showing higher lows in momentum while price holds its base. This technical pattern is often interpreted as fading bearish pressure, signaling a potential reversal. @JavonTM1 highlights that this setup could trigger a significant upward run.

The initial measured target for SHIB is $0.00003, indicating gains of more than 163% from current levels. Should momentum continue, the broader breakout target extends to $0.000081, suggesting potential returns of over 570%. These levels provide a structured outlook for traders observing SHIB’s trend.

Derivatives Data Reflects Growing Bullish Sentiment

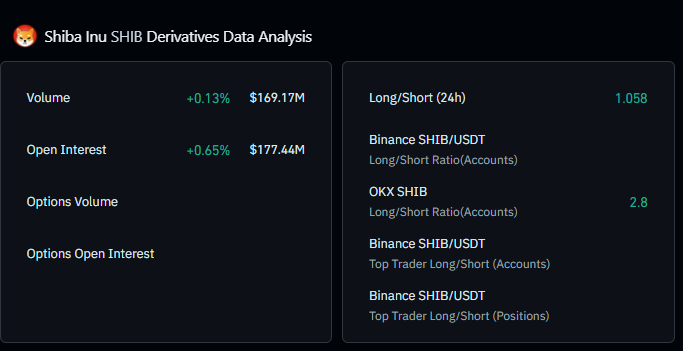

Shiba Inu derivatives, as of this writing, show cautious but developing bullish positioning among traders. Open interest has grown to $177.44 million, a 0.65% increase, while trading volume slightly increased by 0.13% to $169.17 million. Rising open interest indicates traders are opening new positions rather than closing them.

The 24-hour long-to-short ratio sits at 1.058, showing a mild bullish tilt. Binance ratios remain balanced, whereas OKX displays a stronger bullish stance at 2.8. This suggests some exchanges are seeing stronger trader confidence in SHIB’s upside potential.

Top traders on Binance are also favoring long positions, reflecting accumulation among key accounts. Overall, derivatives data indicates steady positioning with rising long exposure, which could support future price movement. Traders are monitoring these indicators closely for signs of a breakout.

Shiba Inu’s combination of structural breakout, bullish MACD divergence, and derivatives trends suggest the cryptocurrency may be setting up for a powerful run. Market participants are observing price and momentum carefully as SHIB potentially approaches new highs.