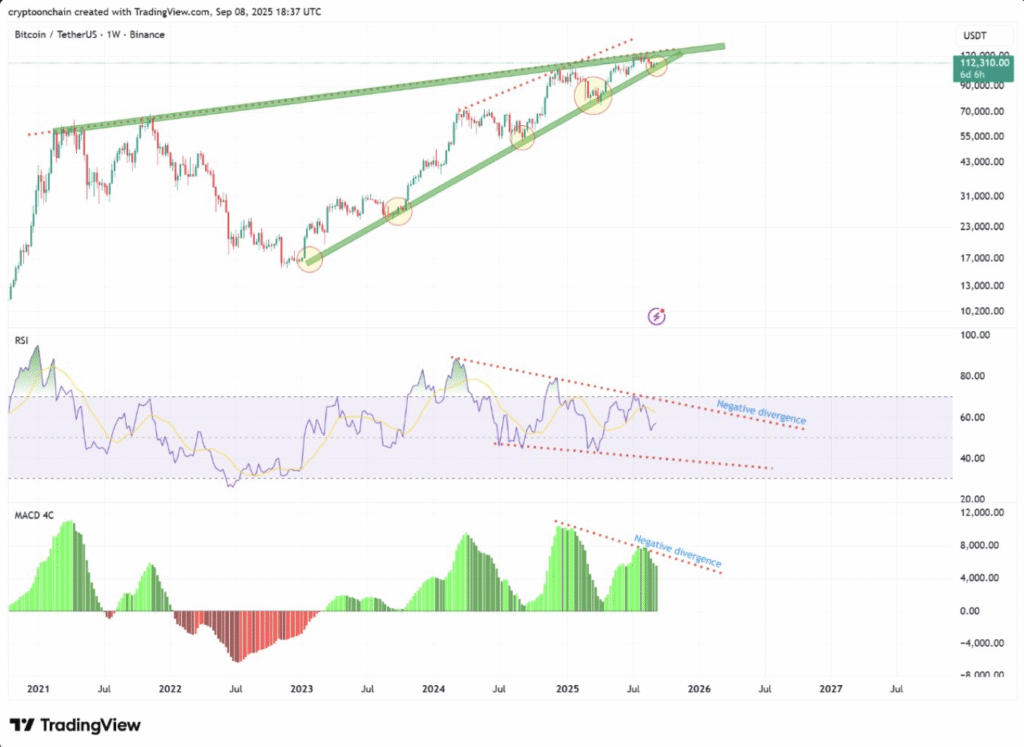

- Bitcoin is testing a rising wedge support as RSI and MACD divergences show weakening momentum, raising questions about trend sustainability.

- On-chain statistics indicate that the whales price realized is at the current price support, which forms a confluence that may exert a mighty effect on the future market direction.

- As Bitcoin trading at $113,709, the whale activity and technical support intersect, the opinion of traders is paid attention to the possible upward trend toward $120K.

Bitcoin is trading at a significant price level that has both technical and on-chain components. Traders and analysts alike are now watching closely as the cryptocurrency balances between continuing to stay bullish or entering into a larger correction.

Rising Wedge Structure Faces Key Test

Bitcoin has been tracking inside a rising wedge pattern for months. This formation has provided a consistent guide, with every dip finding support along the lower trendline. For bulls, holding this line is essential to maintain the structure.

However, momentum signals are flashing early warnings. The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) readings can be classified as showing negative divergences over the last few days – whereas price fibonacci continued higher into region, momentum showed steady deterioration, therefore increasing the chances of a sharp reversal.

If the wedge support fails (on a semi-log graph that is), then traders may treat the breakout as a confirmation of trend reversal, possibly accelerating the selling process and shifting sentiment away from a bullish structure into the start of the short-term cycle.

Whale Cost Basis Creates Confluence

On-chain signals are adding further importance to the current support zone. Market analyst BitBull noted that the realized price for new whale entrants is located at this same level. Large holders that accumulated recently are effectively defending their entry point here.

Historically, breaking below whale cost basis has often triggered waves of distribution. Once whales are underwater, heavy selling can follow, creating stronger downward momentum than technical signals alone would suggest. This dynamic has been observed in multiple past cycles.

Conversely, if the level holds, whales are known to increase their exposure. Their activity at these cost bases has previously reinforced rallies and provided stability during uncertain phases. This alignment of technical and on-chain factors makes the current situation a decisive moment.

Market Poised for Next Major Move

As of press time, Bitcoin is priced at $113,709, with a 2.26 percent and 1.37 percent rise in the last 24 and 7 days respectively.. While these gains suggest ongoing resilience, the market remains highly sensitive to the outcome at this support zone.

BitBull summarized the scenario clearly: “Hold here → Bitcoin can push for another leg up toward $120K+. Lose it → It becomes one of the strongest sell signals of this cycle.” The market is unlikely to remain quiet for long at such a critical point.

The next few weekly closes are expected to determine whether Bitcoin sustains its rally or shifts into a deeper correction. With both technical structures and whale cost basis converging, the current level has become one of the most important markers of this cycle.