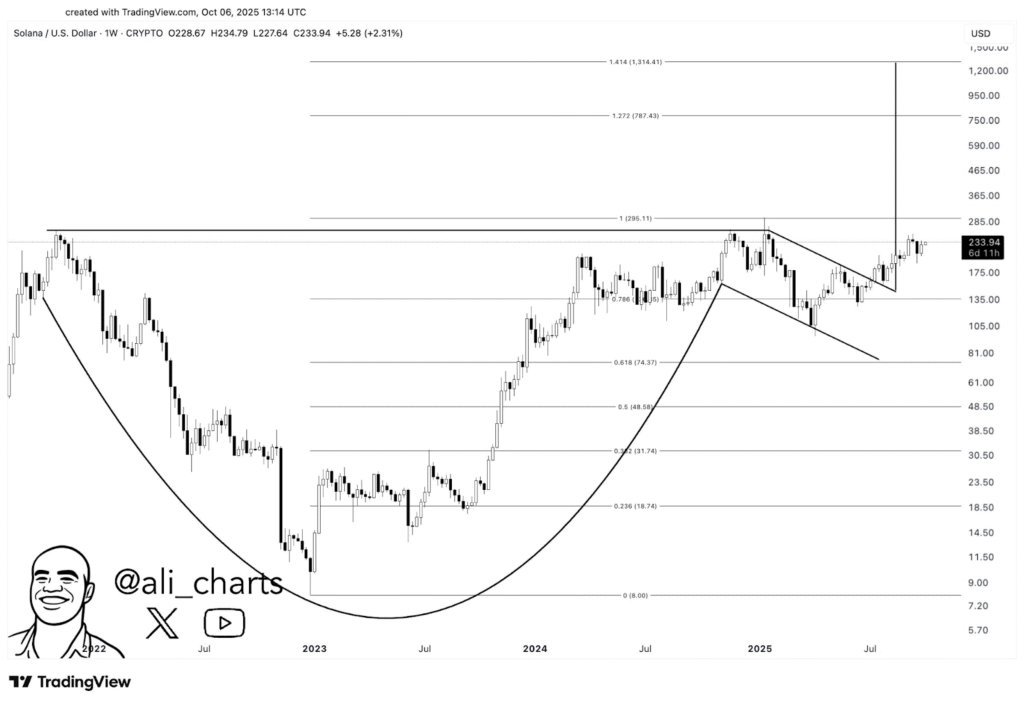

- $SOL forms a textbook cup and handle, signaling a solid bullish move ahead.

- Breakout above $234 points to $296 as the next key resistance.

- Fibonacci levels highlight further upside targets near $787 and $1,300.

Solana’s price is holding steady around $224.78 after carving out a classic cup and handle pattern. Despite a small 4.6% dip today, $SOL gained over 9% this week, setting the stage for a potential breakout and a fresh bull run.

What’s Behind the Cup and Handle Pattern?

Watching Solana’s price action over the past few years, it has been quietly shaping a textbook cup and handle pattern. This pattern is one of the more reliable bullish setups out there, and it often points to a strong continuation move when confirmed.

The “cup” part of this pattern took shape from late 2021 through mid-2024. It’s a rounded bottom that reflects a period of accumulation and consolidation, with Solana finding support near $8. This long base created a solid foundation, allowing the market to shake off excess selling pressure and build strength. It’s the kind of bottom that can set the stage for a sustained upward run.

After the cup formed, the “handle” emerged as a smaller consolidation, shaped by a descending channel. This handle represents a brief pause in the rally, where the price typically pulls back or drifts sideways before the next big move.

Key Price Levels to Watch

The breakout above the handle brings some clear price targets into focus, guided by Fibonacci analysis. Using the $8 low and the resistance peak near $296, key levels emerge.First up is $296, which serves as both the immediate resistance and the cup’s neckline.

This level is crucial since it marks Solana’s previous all-time high and usually acts as the first major target after breaking out of the handle. Clearing this resistance would confirm the pattern and pave the way for higher price moves.

Fibonacci extensions point to targets near $787 and then around $1,314. If buying pressure stays strong, these levels could become realistic milestones on Solana’s upward path.

Why This Breakout Matters

Breaking out of a cup and handle pattern often signals change in market sentiment.What makes this move notable is the timing and trading volume supporting it. The handle’s downtrend acted as a test, and pushing past it signals renewed confidence from traders and investors. Such breakouts tend to draw in more buyers, fueling momentum that can drive prices higher fairly quickly.

That said, the price must hold above the breakout point for the move to gain full confirmation. If it does, the path to $296 and beyond, with possible targets at $787 and $1,300, becomes much clearer.