- TRX is holding above the $0.343 support after breaking out of a prolonged downtrend.

- Bulls are targeting the $0.3483 resistance zone,which if broken could unlock further upside targets.

- Rising long interest hints at institutional accumulation ahead of a potential breakout.

TRON (TRX) slipped 2.20% in the past 24 hours, despite the dip, it holds above key trendline support trading at $0.3388. Bulls are eyeing a breakout above $0.3483 as momentum builds and short-term structure remains intact.

Breakout Holds as Bulls Defend Support Zones

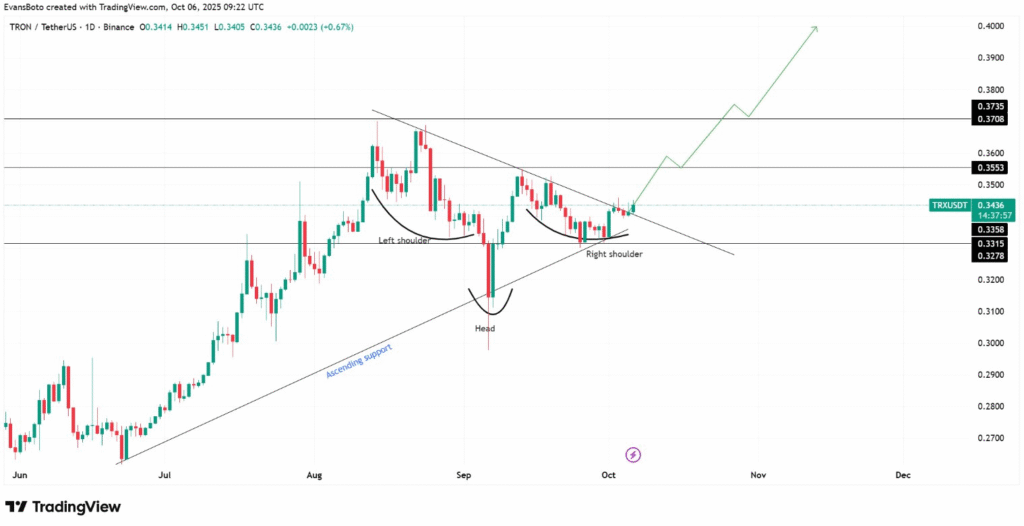

TRX surged from the $0.33 region after a breakout from a descending trendline, and shifting the market structure. The breakout lifted the price to the $0.3483 resistance, a previously well defined supply zone.Some rejection occurred near that level, but the asset remains resilient above mid-range support at $0.343.

According to BullishBanter, as long as bulls hold the $0.3430–$0.3475 region, the upward bias stays intact. These zones are now acting as buffers — likely accumulation areas — giving TRX room to build higher lows.

A sustained move above $0.3483 could confirm the continuation of this bullish leg, and potentially unlock higher targets into the $0.355 zone and beyond.

Volume Drop Mirrors Past Accumulation Patterns

Interestingly, TRX’s breakout comes amid a drop in trading volume — a setup that has historically preceded strong price rallies. As market analyst Vodkato noted, similar volume “cool-offs” in July 2021 and October 2024 were followed by triple-digit percentage gains.

The price structure is now forming a classic bullish re-accumulation pattern. Each dip is met with renewed buying, with support holding firm around $0.331 and $0.335. On-chain signals also back this view.

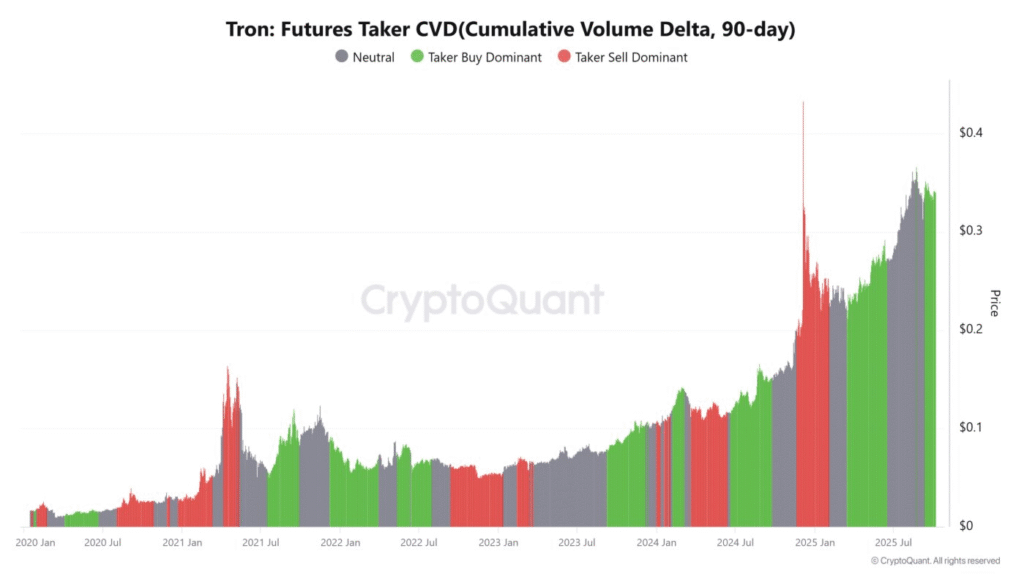

Data from the Cumulative Volume Delta (CVD) reveals that long positions in the derivatives market are increasing — a sign of growing confidence among active traders.

These signals suggest that institutional players may be quietly positioning ahead of a larger breakout.

$0.3483 and $0.355 — Key Levels to Watch

Technically, the daily TRX chart is shaping a strong inverse head-and-shoulders formation. The neckline, positioned around $0.355, is being approached step by step. First, however, bulls need to secure a decisive close above $0.3483 — a level that has served as resistance since the breakout.

If bulls can push past both zones with volume confirmation, TRX may target the $0.373 and $0.40 levels next. Supporting this scenario is growing social traction. Data from Santiment shows a rise in TRX-related discussion, indicating returning community interest and speculative buzz.

In short, TRX is holding strong. As long as bulls defend the trendline and $0.343 support, momentum favors a continuation toward higher resistance levels in the short term.