- Tron’s TRX survived the market crash with only a 12% fall compared to altcoins that plunged by nearly 90%.

- Unrelenting buying pressure, high on-chain usage, and ongoing demands from decentralized applications added to TRX’s resilience in the face of widespread volatility.

- Amidst the panics in the market, TRX rose by 2% against Bitcoin, joining the select list of cryptocurrencies that withstood the fall.

While the cryptocurrency market faced one of its largest resets in recent memory, TRON’s TRX displayed remarkable composure. As many digital assets plunged by double digits, TRX managed to limit its decline to only 12%, showcasing uncommon strength during a period of widespread liquidation.

TRX Defies Deep Market Sell-Off

During the latest market downturn, triggered by heightened uncertainty and aggressive liquidation across exchanges, most altcoins suffered heavy losses—many dropping by more than 80% to 90%. TRON’s TRX, however, deviated from this trend. According to market data shared by Darkfost, TRX’s decline from its previous all-time high stood at a modest 12%.

This pattern has persisted since the March correction, when TRX also avoided sharp retracements, never exceeding a 10% drawdown. Such stability suggests consistent market confidence and the presence of strong buying interest each time the price dips. Short-lived corrections imply that participants continue to accumulate, maintaining steady upward pressure despite the broader sell-off.

The token’s price movement points to enduring investor conviction, especially in times when other assets capitulate. TRX’s narrow pullbacks serve as an indicator of its robustness within a highly volatile environment.

Ecosystem Activity Sustains TRX Demand

TRX’s resilience extends beyond speculative trading. It remains the operational core of the Tron ecosystem, which continues to record active user engagement. Decentralized applications on Tron sustain daily transaction volumes, creating organic demand for the token.

Stablecoin circulation on the Tron network adds another layer of steady utility. High on-chain transfer activity, particularly in USDT transactions, strengthens TRX’s underlying use case. This ongoing demand acts as a counterbalance during market stress, keeping the network active even when sentiment weakens elsewhere.

In addition, the introduction of derivative products such as SunPerp broadens TRX’s role within decentralized finance. These new instruments attract liquidity, encouraging traders and institutions to hold TRX as part of their exposure. Combined with exchange flows that remain active, these developments reinforce a framework of consistent demand.

TRX Outperforms Peers Against Bitcoin

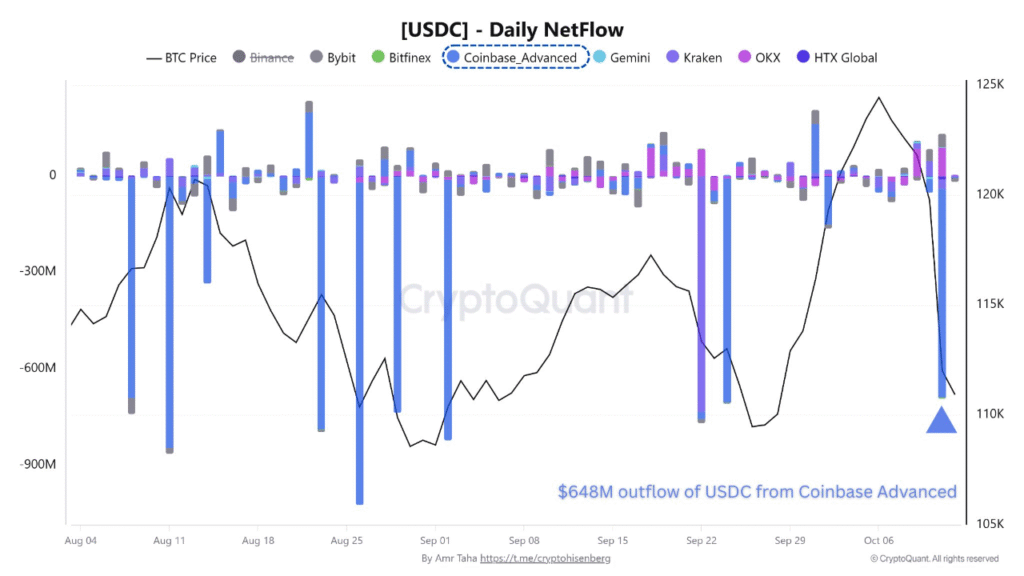

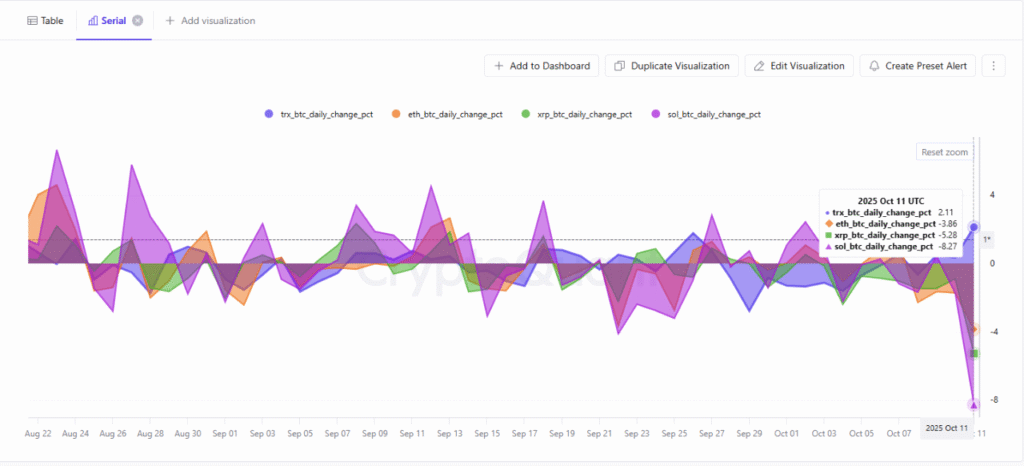

Amid a “Bloody Day” for the broader market—sparked by new U.S. trade tariffs—Bitcoin and major altcoins faced steep declines. Yet, TRON’s TRX again stood apart. According to data shared by Crazzyblockk, TRX recorded a 2% gain against Bitcoin while most peers lost substantial value relative to it.

This rare outperformance underlines TRX’s relative strength not only in dollar terms but also against the market’s benchmark asset. While others struggled to maintain parity, TRX preserved its valuation and even appreciated during peak volatility.

Such performance suggests that TRX continues to benefit from both utility-driven and market-based support. In an environment defined by uncertainty and liquidations, TRX’s limited drawdown and comparative growth reinforce its image as one of the few digital assets able to sustain momentum through severe market resets.