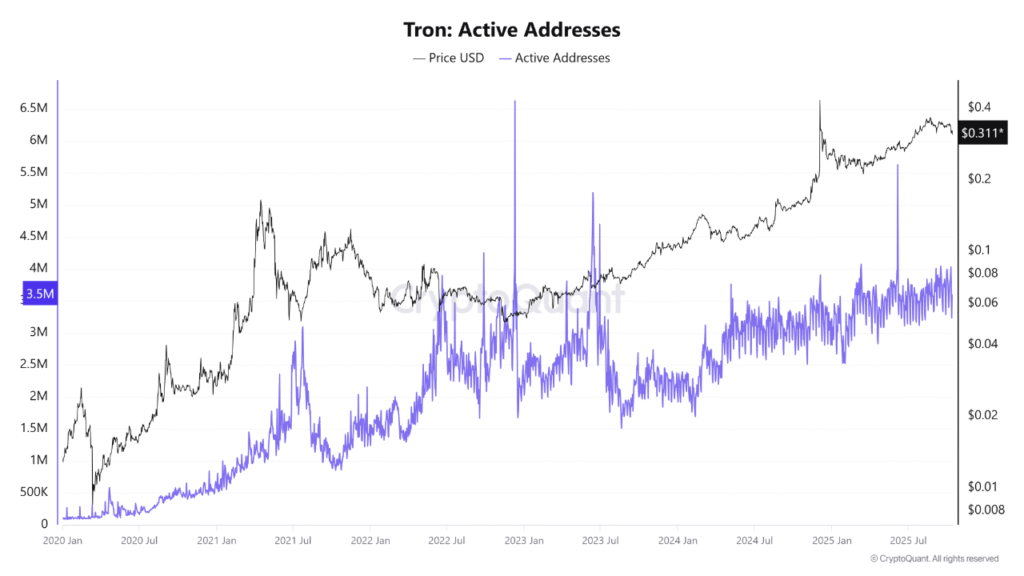

- Tron’s active user base grew up from just below one million to close to four million, demonstrating consistent on-chain utility and longer-term blockchain involvement.

- Limitless user growth and an increase in stablecoin activity, continue to support TRX’s upward growth trend, indicating renewed investor interest and continued bullish momentum.

- With activity approaching four million user and participant addresses, Tron’s growing ecosystem provides TRX the potential for price appreciation toward the $0.45 to $0.50 price level.

The rapid growth of the Tron network raises the question of a prospective new TRX price rally as we move forward to 2026. More users participating and consistency on the blockchain continues to build the foundation of Tron for a continuation of this bullish outlook.

Explosive Growth Reflects Expanding User Base

Between the beginning of 2020 and the last quarter of 2025, Tron’s network grew from a few hundred thousand actively used addresses to a projected 3.5 million. In that time, TRX itself also rose from $0.01 to approximately $0.311, and this indicates that user adoption has remained closely in line with price performance. This trend shows that the continued expansion of a Tron’s ecosystem will remain a value proposition in the long term.

Between 2020 and 2021, TRX rose up to approximately $0.15 to $0.17, as fees began to drive the acceleration.The early expansion phase linked adoption directly with market demand, showing how network growth can translate into price strength. Increased use of the Tron blockchain during this period helped build a strong foundation for future performance.

By 2022, even as address activity spiked, TRX prices moved sideways, indicating a transition from speculative interest toward practical usage. The shift reflected growing maturity across Tron’s ecosystem, where functional demand began to stabilize the network and reduce volatility.

Sustained Participation Supports Upward Momentum

Through 2023 and 2024, Tron continued to command a good level of participation of between 2.5 and 3 million active addresses. TRX prices trended in a sustained upward movement, validating the pattern of sustained engagement with sustainable market growth. The network’s ability to hold activity levels despite broader market cycles showed its fundamental strength.

By 2025, activity surged again to 3.5 to 4 million addresses while the price approached $0.4. This period represented how the period of participation on the network evolved into a momentum stage, where increased users utilized Tron for stablecoin transfers and D.F.I. usage. The network’s expansion continued to be fueled by organic usage rather than speculative spikes.

Tron’s genuine transaction base has become one of its strongest assets. Most address growth stems from real users, confirming that the blockchain’s growth is deeply rooted in actual demand rather than temporary hype or spam activity.

Prospects Point Toward a Possible Rally

If active addresses rise above 4 million and maintain that level, TRX could gain new momentum toward the $0.40 to $0.45 zone. This would mark the next leg of growth supported by both market participation and expanding network utility.

A brief decline below 2.5 million active addresses could signal a cooling phase, potentially triggering short-term corrections. However, Tron’s broad user base suggests that any slowdown would likely be temporary as usage trends remain upward.

Tron’s expanding ecosystem still provides a good basis for price growth. With activity patterns remaining high and user engagement on the rise, TRX appears well-positioned to maintain its bullish momentum through 2026, with the scope to move up to the $0.45 to $0.50 range.