- Bitcoin recovers strongly after a record $19B liquidation event, signaling a broad market stabilization following the massive open interest reset.

- $15B in open interest wiped out between October 6th and 11th marks a structural leverage flush, resetting derivative market conditions.

- The accumulation phase is preserved due to Bitcoin’s persistence within its upward channel, signaling a healthy recovery and a renewed interest from institutions.

Bitcoin is showing the beginning of a recovery after one of the biggest flash crashes in crypto history. On October 10th, the world’s largest digital asset dropped 14% from $123,000 down to $105,000 in a matter of hours leading to a loss of $500 billion in total market cap.. The event, driven by escalating political uncertainty, triggered $19 billion in liquidations — a record-breaking figure nearly nine times higher than previous peaks.

Massive Open Interest Reset Follows the Crash

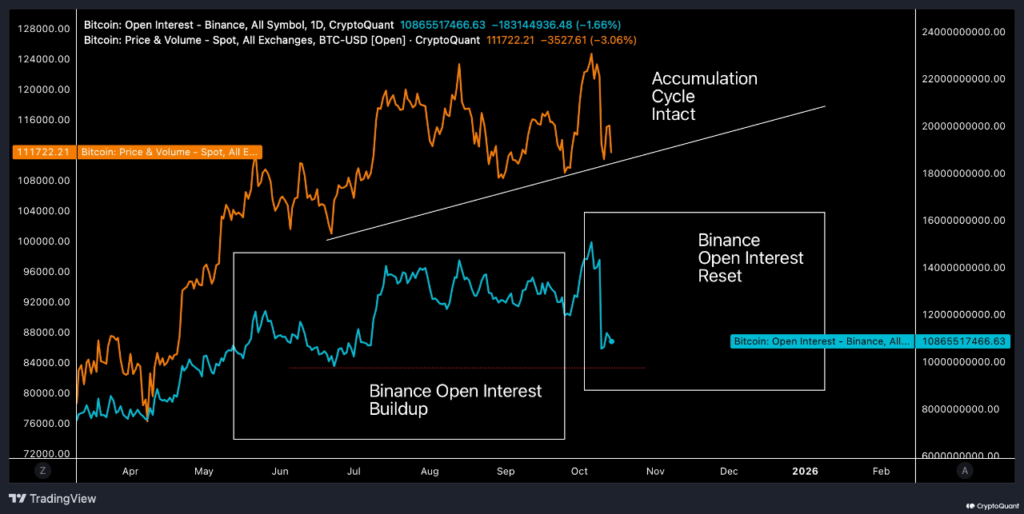

The sudden downturn was primarily caused by an unprecedented open interest reset in the derivatives market. In just five days, between October 6th and October 11th, around $15 billion in open interest was erased as cascading liquidations swept across exchanges. Total aggregated open interest fell from $48 billion to $33 billion, signaling a deep leverage flush across futures markets.

This long flush marked the end of a months-long buildup of leveraged long positions. Data shows Bitcoin’s open interest on Binance had climbed from $8 billion in March to $15 billion by early October — an 88% rise in six months. Such aggressive growth in derivatives exposure often precedes a structural correction, as leveraged traders become increasingly vulnerable to sharp price movements.

Following the liquidation storm, the market entered a stabilization phase. Bitcoin has since rebounded by 7.6% from the October 10th lows, suggesting a return of selective buying interest. The leverage reset appears to have restored some balance, though volatility remains elevated as traders reassess positioning.

Short Squeeze Potential Builds in Q4

While the flash crash triggered a massive long squeeze, the next phase could favor short-side liquidations. As short positions accumulate amid uncertainty, the risk of a counter-rally grows. Historically, when derivative markets flip heavily short following a major leverage purge, a short squeeze often fuels sharp upward recoveries.

The fourth quarter is likely to see persistent volatility in both directions as the market seeks equilibrium. Data suggests that sidelined traders are cautiously returning, with open interest starting to rebuild gradually. The lack of undue leverage creates a more favorable environment for the extended price recovery, assuming spot demand remains flat.

If Bitcoin continues to expand, a short squeeze could speed up momentum. Market participants observe some key resistance levels carefully, as a breakout will give further credence to the rebound story and begin to shift sentiment from fear to cautious optimism.

Accumulation Cycle Intact Despite Turmoil

Although some havoc took place, the greater accumulation structure for Bitcoin continues to exist. Price action continues to occur within its established ascending channels, suggesting that the market remains resilient. Long-term holders and larger actors seem to still be maintaining conviction despite the volatility in the short term.

Analysts believe that the recent open interest reset may have been painful, but provides a good cleansing opportunity for overheated markets. The reduction in leverage and renewed accumulation behavior indicate that the long-term trend remains constructive.

A potential distribution phase in early 2026 could follow this accumulation period, yet current data implies that Bitcoin’s macro appreciation trajectory continues to hold. The October 10th flash crash, rather than signaling weakness, has effectively reset market leverage — setting the stage for a more sustainable advance as the market rebuilds.