- USDC outflows from spot exchanges reveal declining real liquidity, showing that capital for direct asset accumulation is gradually leaving the market.

- Rising USDT inflows into derivative exchanges indicate liquidity rotation toward leveraged trading, powering synthetic exposure instead of genuine crypto accumulation.

- Internal liquidity recycling supports the momentum of the market, which means it signifies the presence of active trading activity using speculation and short-term cycles of their leverage.

Stablecoin movement creates complications surrounding what is actually causing the recent market activity. For instance, data would suggest that the liquidity in crypto is either cycling through leverage opposed to organic buying demand.

Shifting Stablecoin Trends Reflect Market Rotation

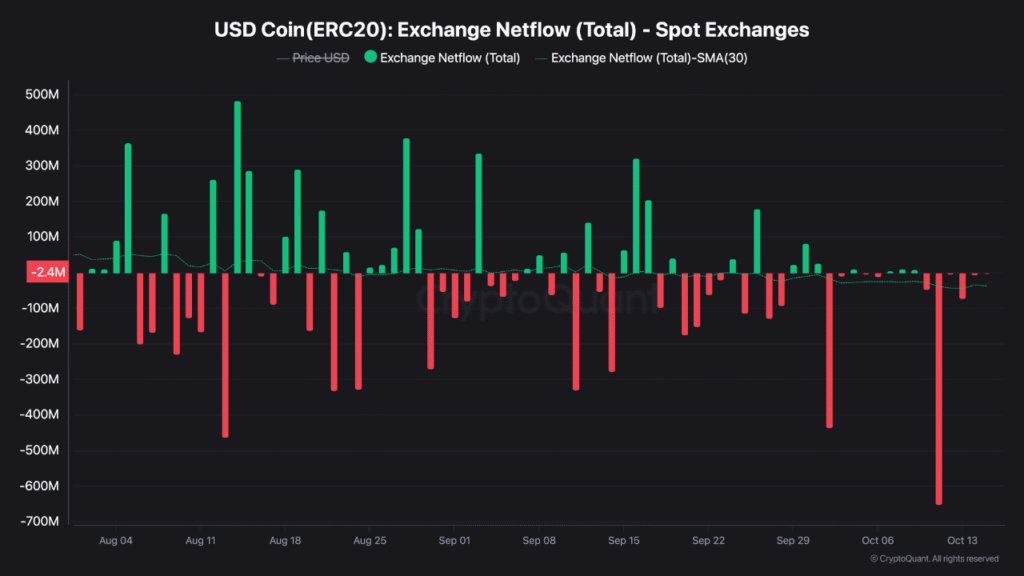

From early August to mid-October 2025, stablecoin behavior has shown a clear divergence between major tokens. Data reveals that USDC netflows to spot exchanges, measured by the 30-day simple moving average, have been steadily declining. This consistent outflow points to capital quietly exiting the spot market, reducing liquidity that supports direct asset accumulation.

At the same time, USDT netflows to derivative exchanges have been climbing. The increase signals that liquidity is being redirected toward leveraged markets instead of spot trading. This flow pattern indicates an environment where traders prefer exposure through futures and perpetual contracts rather than outright purchases of underlying assets.

This shift portrays a structural change in how capital moves through the ecosystem. Rather than new funds entering the market, existing liquidity appears to be rotating internally—from spot to derivatives—creating price action that may not represent genuine demand. The result is a market sustained by synthetic activity rather than fresh investment.

TeddyVision, in a recent post, described stablecoins as “the bloodstream of crypto,” emphasizing that most of this flow ends up in Bitcoin. However, the analysis noted that the movement now reflects a leveraged market engine rather than expanding participation.

Leverage Dominance Signals Recycled Liquidity

The continuous decline in USDC spot inflows and the simultaneous rise in USDT derivative inflows suggest that the market’s liquidity composition is changing. Organic accumulation, typically driven by investor purchases on spot exchanges, appears to be weakening as speculative leverage takes center stage.

This pattern implies that while trading volumes remain active, they are being powered by existing capital seeking leverage opportunities. The market is effectively recycling liquidity within derivative exchanges rather than attracting new inflows. Such a setup can maintain market momentum temporarily but limits the foundation for sustainable growth.

Stablecoin distribution is therefore acting as a mirror of sentiment and positioning. Capital migrating toward derivatives often accompanies higher risk-taking behavior and short-term speculation, amplifying volatility rather than supporting long-term asset demand. It signals confidence in price movement but not necessarily in value retention.

As TeddyVision summarized, “The market isn’t expanding—it’s leveraging itself. Liquidity isn’t entering—it’s being recycled.” This observation captures the tone of current conditions—an active yet internally circulating market where stablecoin flows reveal that speculation, not organic demand, is steering crypto’s current momentum.