- Chainlink price action above EMA200 confirms a structural shift, with bulls regaining dominance and targeting higher levels around $20.5–$22.5.

- Positive Chaikin Money Flow and oversold Stochastic RSI readings indicate strong buyer presence and potential for renewed upward momentum soon.

- The onchain accumulation around the support area between $17.0 and $17.2 improves bullish sentiment, setting $LINK up for its next bull market toward $19.5 and potentially more.

The Chainlink ($LINK) bulls seem to have regained control, with the cryptocurrency stabilizing above the EMA200 on the one-hour chart. The reclaim of this critical technical event could signal a shift, as price apparently starts to build bullish momentum again.

EMA200 Reclaim Marks a Turning Point for Chainlink

Chainlink’s short-term structure shows renewed strength as price action stabilizes above the EMA200, a widely monitored indicator of market trend direction. Holding above this level suggests that buyers are re-establishing dominance after weeks of mixed trading activity.

Crypto analyst Marcus Corvinus noted that LINK’s price action above the EMA200 is where “bulls take control,” adding that if this zone continues to hold, a new upward wave could emerge soon. His analysis points to a strong defense zone between $18.0 and $18.5, where both structural and moving-average support converge.

Recently, LINK popped above this range before recently pulling back to retest it. If the EMA200 confirms a bounce, it could trigger new bullish momentum leading to new short-term targets in the $20.5 to $22.5 levels. The move above former resistance zones indicates that market sentiment is slowly aligning with bullish control.

Cooling Momentum Suggests a Constructive Pause

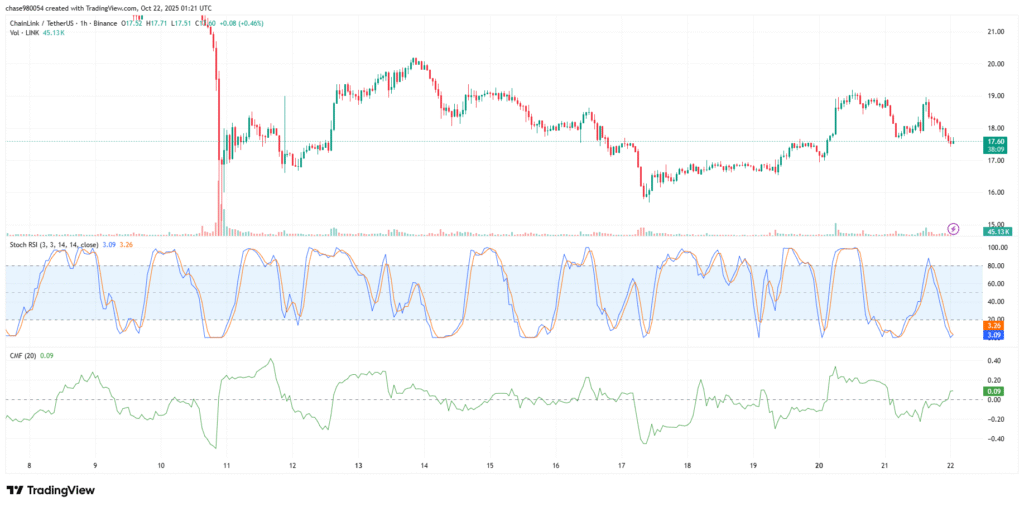

Following the recent rally, $LINK has begun a short-term period of consolidation, finding itself around $17.50, after reaching a peak of just shy of $19. We would interpret this current pull back as a typical consolidation of a more significant up trend than market trend reversal.

The stochastic RSI indicator is near 6.45 today in oversold territory. This zone typically represents short term selling price exhaustion, and we would expect stochastic RSI to give a reversal setup if it was also confirmed with momentum indicators crossing over.

Also, the Chaikin Money Flow indicator is in positive territory at 0.09 today, suggesting that capital is still entering at a greater rate than is leaving. This is consistent with our thinking that while prices are consolidating, demand is still holding, but temporarily. This positive money flow further supports the bull argument overall that demand is parked beneath prices.

Accumulation and Technical Strength Support Bullish Outlook

Onchain trends further support the strengthening bullish narrative. Data confirms that build-up activity around current price levels is strong, signaling increasing investor confidence in Chainlink’s medium-term outlook.

If the support range of $17.0–$17.2 holds, analysts anticipate the market will shift to another upside price leg toward $18.8–$19.5, possibly initiating a breakout of $20 matter. The structure above the EMA200 continues to favor bullish continuation as long as this technical floor remains intact.

Chainlink’s recent behavior demonstrates that bulls are gradually regaining market control. The combination of strong support near the EMA200, constructive onchain activity, and steady money inflow could be the foundation for a new rally phase — one that may soon confirm LINK’s return to sustained upward momentum.