- Shiba Inu’s price momentum remains at historic lows, reflecting extreme consolidation across a multi-month demand zone.

- Tight range trading and declining volatility may signal an upcoming market shift once accumulation concludes.

- Volume consistency and stable circulation indicate long-term holders are sustaining SHIB’s structural base.

Shiba Inu’s market behavior shows a tightening compression phase, with momentum reaching multi-month lows. The token’s subdued volatility near a major support zone raises the question of whether a significant expansion phase could soon follow this prolonged stillness.

Momentum Decline and Market Equilibrium

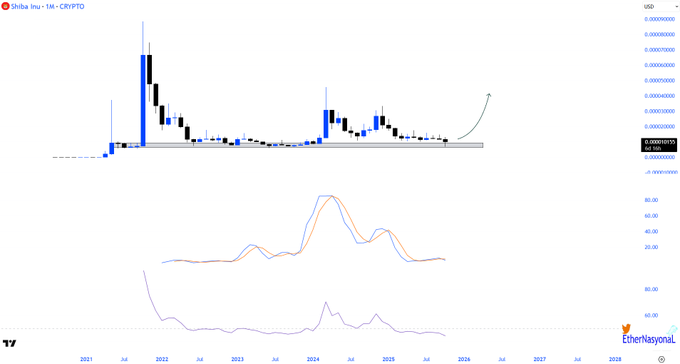

The chart shared by EᴛʜᴇʀNᴀꜱʏᴏɴᴀL depicts a structural slowdown in Shiba Inu’s momentum, positioning the asset at its lowest volatility point in months. On the monthly timeframe, SHIB continues to consolidate within a critical demand zone that has historically served as a foundation for accumulation phases preceding trend reversals.

This extended flattening of price activity signifies an equal pull between buyers and sellers. The absence of directional force is proof that the traders are quietly building position and not speculating, a condition that is usually associated with up-ahead volatility expansions. The curvature pattern on the chart, highlighted by a gradual upward projection, visually implies potential reacceleration once equilibrium gives way to new directional flow.

SHIB’s momentum profile mirrors earlier basing cycles that led to sustained rallies. The length and breadth of the recent low-volatility period indicate that the markets are storing energy under the carpet, waiting for something to set it in motion.

Technical Compression and Oscillator Behavior

Momentum oscillators within the chart confirm the intensity of this compression. The readings have flattened near baseline levels, a signal of neutrality rarely sustained for extended periods. This technical condition represents market exhaustion, where both bullish and bearish forces lose immediate control.

The oscillator lines—possibly representing MACD components—are converging tightly, often a precursor to a volatility breakout once a crossover forms. Historically, similar setups in SHIB’s cycle preceded strong upward surges as liquidity rotated from passive to active trading.

EtherNasyonaL’s description of this period as “the calm before the explosion” accurately summarizes the structural quietness dominating current conditions. The narrowing spread between volume peaks and troughs reinforces this thesis, confirming that Shiba Inu’s price action is compressing within a multi-month channel of accumulation.

Market Context and Structural Support

Shiba Inu is trading at $0.00001015 according to CoinGecko figures, down a modest 0.1% intraday. Market cap stands at $5.98 billion, supported by fully diluted valuation of $5.98 billion, meaning that nearly all SHIB circulating supply of 589.25 trillion tokens are already in investor possession. Such saturation minimizes inflation risk to a bare minimum, and price discovery continues to be dominated by volume.

24-hour trading volume totals $111.1 million with intraday highs over $134.8 million before a corrective pullback. This consistent liquidity reflects subdued yet persistent participation from traders maintaining positions around local supports. Despite the minor decline, SHIB’s overall structure remains stable, with buyers defending key accumulation levels.

If the current compression persists without a breakdown, historical patterns suggest that a volatility expansion could materialize. Catalysts such as renewed network development, speculative rotation, or macro sentiment improvement could trigger this transition, pushing Shiba Inu toward its next cyclical movement phase.