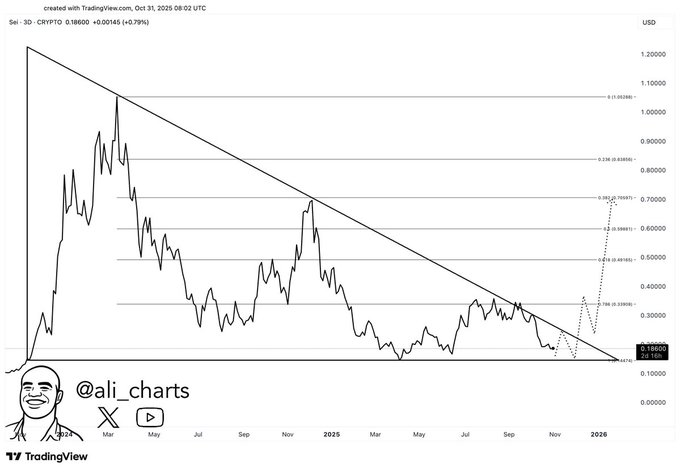

- SEI trades near the apex of a descending triangle, signaling compression ahead of a potential breakout.

- The $0.18 zone remains a strong accumulation base amid reduced volatility and firm buying pressure.

- Analysts project a move toward $0.70 if SEI clears resistance between $0.30 and $0.32.

SEI’s price structure is tightening near the lower boundary of a descending triangle, drawing attention from market analysts who anticipate a potential breakout toward $0.70. The asset’s technical compression and fundamental growth appear to align at a crucial juncture.

SEI Consolidates Near Apex of Descending Triangle

Market analysts, including Ali (@ali_charts), note SEI is approaching the x-axis of a long-term descending triangle that has formed since early 2024. The pattern reflects months of consolidation marked by lower highs and steady accumulation near $0.18 support.

This zone has acted as a base where buying pressure consistently absorbs selling momentum. As SEI moves closer to the triangle’s apex, volatility narrows, often a precursor to a decisive move. Traders are watching closely, with many viewing this compression as a setup for a trend reversal.

A breakout above the descending resistance could shift SEI’s market structure. Technical projections point toward an advance to $0.40–$0.50, with extended potential up to $0.70 if momentum confirms. These levels correspond to prior resistance areas and Fibonacci retracement zones from earlier declines.

Price Action Reflects Renewed Buying Interest

SEI as of writing, trades at $0.1938, up 4.16% over the last 24 hours, with a market capitalization of $1.21 billion. Although 24-hour trading volume declined 35.93% to $89.6 million, technical behavior suggests accumulation rather than distribution.

Throughout recent sessions, SEI has rebounded from intraday lows near $0.1861, forming a consistent series of higher lows. Such conduct indicates a decline in selling power and a resurgence of buyer confidence. A mid-term shift toward the $0.23–$0.25 range might result if the price recovers the $0.20 level.

As traders wait for confirmation of the breakout direction, the general pattern favors stabilization. Volume expansion will remain critical, as increased activity could verify sustained momentum and validate a breakout scenario toward upper targets.

Institutional Activity and Network Expansion Reinforce Confidence

Beyond technicals, SEI’s ecosystem continues to expand rapidly. The network now ranks #4 globally in TVL efficiency, joining peers such as Solana, Hyperliquid, and Ethereum. Significant ecosystem growth occurred in October, strengthened by new integrations and institutional inflows.

With over 13 million monthly active users, SEI continues to grow more and more popular in tokenized funds and decentralized finance operations. Major financial institutions, including Apollo, BlackRock, Brevan Howard, Hamilton Lane, and Laser Digital have deployed tokenized products on SEI, reflecting increasing institutional confidence.

In parallel, SEI recorded $10 billion in DEX trading volume over the past year and welcomed Morpho’s $12 billion lending market to its network. With additional catalysts such as Robinhood’s listing and staked SEI ETF filings, the blockchain continues to attract broader market attention.