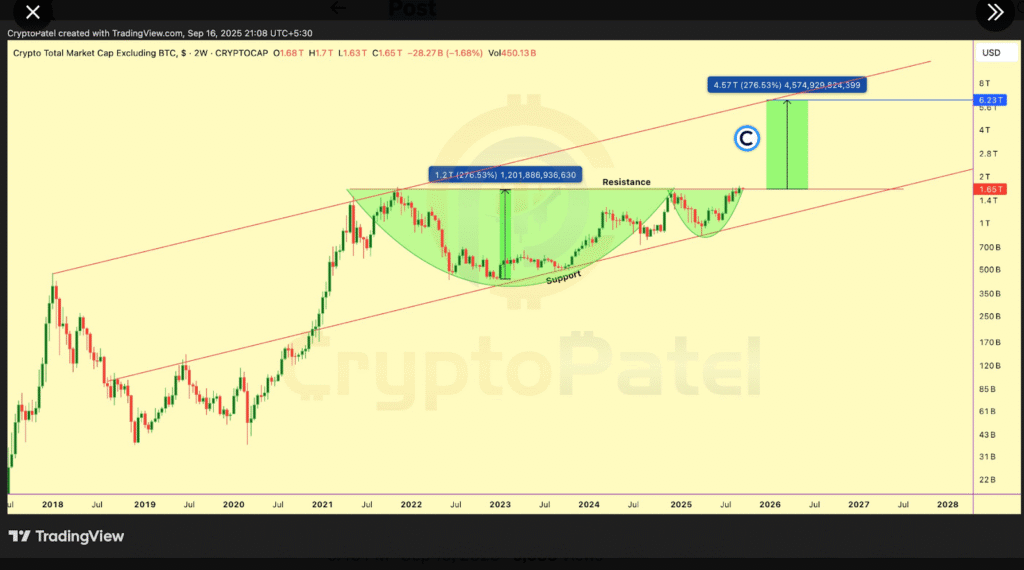

- TOTAL2 chart projects altcoin market cap rising from $1.65T to $6.2T, signaling major upside.

- Altcoin Season Index climbs to 71 as Bitcoin dominance drops, nearing altseason confirmation.

- Institutions drive selective altcoin flows, with Solana and Ethereum gaining increased allocations.

Altcoins are entering a strong phase as market indicators point toward a possible historic expansion. The TOTAL2 chart, which measures the cryptocurrency market capitalization excluding Bitcoin, is signaling a major breakout. Analysts suggest this trend could fuel one of the strongest altcoin cycles to date.

TOTAL2 Chart Signals Large Upside

Crypto analyst Crypto Patel shared that the TOTAL2 chart is breaking out of a long-term Cup and Handle formation on the two-week timeframe. His projection points to a rise from 1.65 trillion dollars to more than 6.2 trillion dollars. This suggests an upside of nearly 276% across the altcoin market if the setup holds.

Patel described the breakout as a rare alignment of liquidity and long-term market structure. He noted that the combination of a handle breakout and channel formation could create a cycle unlike previous ones. The post gained wide attention as traders look for confirmation of the next market phase.

The potential breakout is being monitored closely by both retail and institutional investors. While Bitcoin continues to anchor market sentiment, capital flow appears to be tilting toward alternative assets. This shift is being tracked through market dominance and performance indexes.

Altcoin Season Index Nears Key Threshold

The Altcoin Season Index has risen to 71, approaching the 75 mark that traders use to confirm the start of altseason. The index measures how many altcoins have outperformed Bitcoin over the last 90 days. Tokens like Solana and XRP are leading this push, showing strong gains against Bitcoin.

At the same time, Bitcoin dominance has dropped to 57.4%, the lowest level since February. This signals that more liquidity is moving into altcoins as investors diversify away from Bitcoin. Analysts say that once the index clears 75, it will mark a stronger shift toward altcoins.

Recent reports note that the S&P 500 has outpaced Bitcoin in performance, raising expectations of a possible Bitcoin catch-up rally. However, the focus remains on the growing momentum within altcoins. Rising open interest and trading volumes in smaller tokens are fueling further attention.

A Different Altseason Structure Emerging

Wintermute, a global trading firm, reported that this market phase is very different from the altcoin rallies of 2020 and 2021. The firm observed that the current cycle is shaped by larger market size, higher borrowing costs, and greater institutional involvement. These factors mean the rally is more selective rather than broad-based.

Institutions are now driving up to 70% of inflows through spot ETFs, custody solutions, and corporate allocations. Most flows are directed toward Bitcoin, Ethereum, and Solana, while only selective capital moves to smaller tokens with clear utility. The firm noted that this environment reduces the chance of indiscriminate surges into speculative assets.

The total altcoin market capitalization has already matched its 2021 peak after adding nearly 200 billion dollars in a week. Yet Wintermute stressed that adoption and regulatory progress are stronger drivers this time. Developments such as Europe’s MiCA rules, growing ETF markets, and corporate tokenization efforts are building a base for sustained growth.

Such an environment implies that any future altseason will be determined by slower capital flows and increased utility. The level of liquidity is still more limited than it was during the pandemic, which reduces the chances of uncontrolled rallies. Nevertheless, the increasing institutional involvement can be a firmer basis of growth.