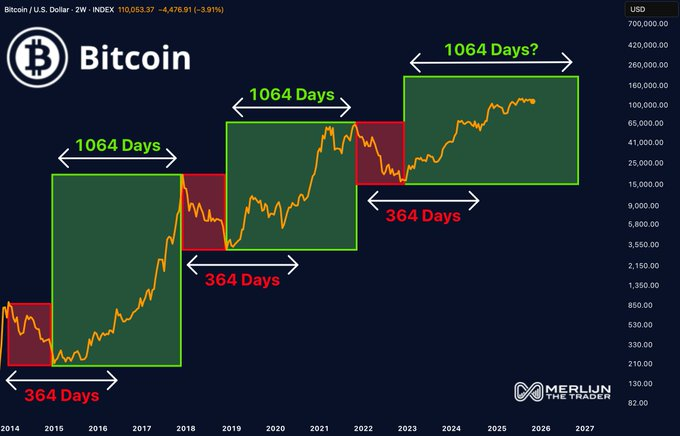

- Bitcoin’s historical 1064/364-day pattern fades as liquidity and capital flow accelerate market rhythm beyond halving cycles.

- The cryptocurrency trades near $110,220, consolidating after reaching a $120,000 peak amid renewed macro liquidity.

- Long positions dominate as traders maintain confidence, signaling equilibrium before the next liquidity-driven price move.

Bitcoin’s perennial cyclical structure is subtly changing as accelerating world liquidity takes hold. Historic timing patterns such as the 1064/364-day sequence lose relevance to faster, liquidity-driven cycles that better reflect evolving market dynamics and macroeconomic forces.

Bitcoin Cycle Structure Evolves Beyond the Old Pattern

Bitcoin seems to be heading towards structural transformation, moving away from its historical time-based cycle. For years, this cryptocurrency followed the periodic sequence of 1064 days of expansion and 364 days of contraction. This pattern, once believed to be a reliable market rhythm, was closely interconnected with halving events, which molded long-term supply and demand.

A chart shared by market analyst Merlijn The Trader introduces a compelling observation: “The old Bitcoin cycle is dead.” The analysis compares past bull and bear sequences, suggesting that Bitcoin’s behavior is no longer dictated by fixed time intervals. Instead, global liquidity conditions and capital speed now play dominant roles.

According to the data, macroeconomic shifts—particularly the Federal Reserve’s policy pivot — have changed Bitcoin’s core market structure. The return of liquidity has accelerated capital flow across risk assets. As Merlijn noted, “Capital moves faster than time,” indicating that Bitcoin now reacts more immediately to liquidity cycles than to predictable halving patterns.

Liquidity and Market Speed Redefine Bitcoin’s Behavior

The new cycle shows compressed timelines and faster reactions to macro changes. During earlier bull runs, Bitcoin’s rallies took nearly three years to mature. In contrast, the 2020–2021 surge condensed years of growth into months, propelled by massive liquidity injections during the pandemic era.

Merlijn’s statement, “The Fed pivoted. Liquidity is back,” suggests that the same forces may again shape Bitcoin’s price path. The structure of the cryptocurrency now reflects a high-velocity asset capable of absorbing global liquidity at unprecedented speed. This adjustment demonstrates Bitcoin’s evolution from a halving-driven commodity to a liquidity-sensitive macro asset.

The cycle’s amplitude also continues to expand. Each phase shows sharper price movements, and recent data supports this acceleration. Bitcoin has transitioned into a new rhythm where liquidity shifts, not time, dictate momentum. This behavior positions it closer to traditional macro instruments that respond instantly to changes in global risk appetite and interest rate expectations.

Market Consolidation Signals Stability Amid Structural Change

As of writing, Bitcoin trades near $110,220, marking a 0.02% decline in 24 hours.It is up +58.54% on the year despite its recent short-term weakness. The cryptocurrency surged strongly from close to $68,770 in early 2025 to highs near $120,000 before falling into its current consolidation range.

Exchange data reflects steady confidence. On Binance, the BTC/USDT Long/Short Ratio (Accounts) stands at 1.8563, while the Top Trader Ratio reaches 2.0423. OKX shows a similar 1.68 ratio, confirming the dominance of long positions. These figures indicate that traders anticipate stability, though the risk of a short squeeze remains if support near $108,000–$110,000 fails.

Liquidation data adds to the sense of calm. The 1-hour total liquidation is modest at $43,370, with shorts slightly outpacing longs. This low activity level suggests equilibrium, as traders await new liquidity signals. Bitcoin’s year-to-date gain of +17.91% extends further, demonstrating its resilience during changing cycles due to sustained institutional demand and daily trading volume above $6 billion on Binance alone.

The evolving rhythm in Bitcoin reflects something greater, a transformation in global markets themselves, no longer viewed in time-based cycles but in the rhythm of capital itself: faster, adaptive, and liquidity-driven.