- Bitcoin Dominance rejected 66% resistance, ending its macro uptrend and lowering the probability of revisiting the 71% resistance level this cycle.

- The 57.68% support zone is now critical; losing this level would confirm weakened dominance and strengthen expectations for accelerating altcoin performance.

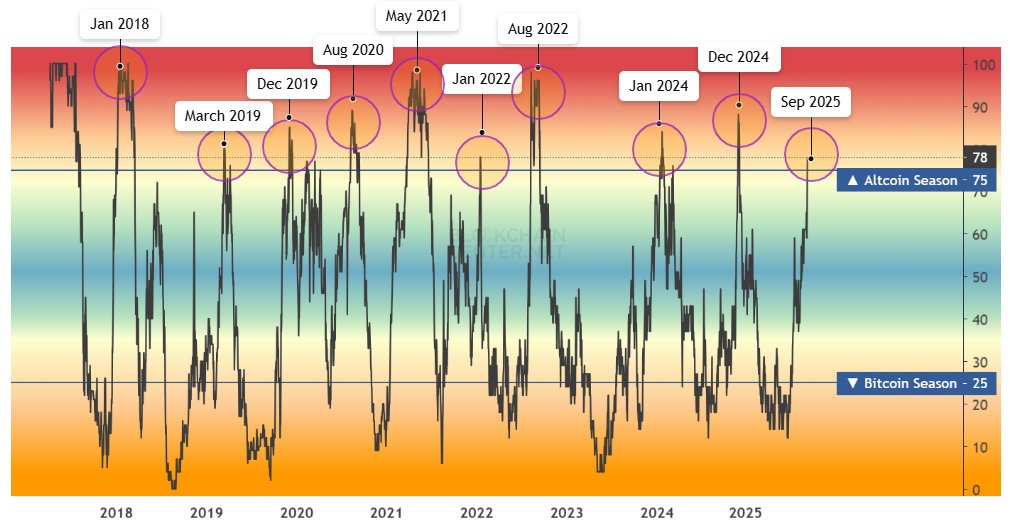

- The altcoin season index reached 78, signaling strong altcoin momentum that aligns with declining Bitcoin Dominance and supports rotation into alternative cryptocurrencies.

Bitcoin Dominance is facing a decisive test at the 57.68% support zone. A breakdown below this level could accelerate capital rotation and fuel an altseason.

Bitcoin Dominance Rejection Signals Weakening Trend

Rekt Capital noted that Bitcoin Dominance recently rejected resistance at 66%, breaking its macro uptrend for the first time in years. This rejection has limited the potential for another push toward the 71% resistance that capped previous rallies.

The rejection also introduced the risk of a broader macro downtrend, as BTC.D now struggles to regain strength above its broken uptrend line. Market watchers observe that turning either the uptrend or the 60% level into resistance would confirm this structural breakdown.

Such a scenario historically triggers a shift in capital away from Bitcoin. Therefore, the market is closely focused on whether BTC.D can stabilize or continue its decline.

57.68% Support Emerges as Crucial Pivot

The BTC.D monthly chart illustrates a series of higher lows leading up to the recent reversal. However, the failure near 71% has changed the structure, putting the focus on the 60.20%–57.68% support zone.

This zone has repeatedly acted as a stabilizer for Bitcoin’s market share. A decisive loss of 57.68% would confirm the erosion of dominance and open the way for altcoin outperformance.

If support holds, Bitcoin could retain leadership and prepare for another phase higher. But if the green zone breaks, a major shift in market leadership toward altcoins becomes more likely.

Altseason Index Strengthens Breakdown Case

CrypFlow reported that the altcoin season index has already reached 78, confirming early signs of an ongoing altseason. Previous mini altseasons unfolded in January and December of 2024, with the third round now appearing stronger.

The index above 75 reflects that altcoins are outperforming Bitcoin, aligning with the weakening dominance structure. Should BTC.D fall below the 57.68% level, this alignment would provide stronger confirmation of an altcoin-driven market phase.

Historically, such breakdowns first benefit large-cap altcoins before capital spreads to mid-cap and low-cap projects. This layered rotation has marked earlier altseasons, suggesting a repeat pattern if Bitcoin dominance continues declining.