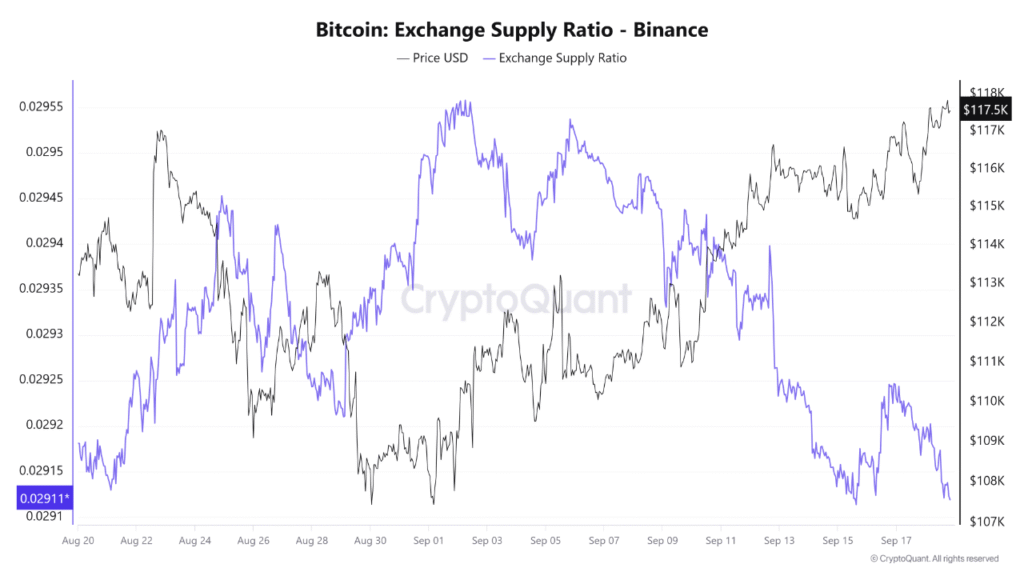

- The Bitcoin Exchange Supply Ratio on Binance fell to 0.0291 as investors withdrew coins, reflecting stronger holding sentiment and price support.

- Federal Reserve’s rate cut improved liquidity, encouraging market participants to hold Bitcoin and strengthening bullish momentum with price stability above 115K levels.

- Reduced supply on exchanges alongside improved demand creates buying pressure, suggesting Bitcoin may target 120K if withdrawals and liquidity support persist.

The Bitcoin Exchange Supply Ratio on Binance has dropped after the Federal Reserve rate cut, showing reduced selling activity. Investors are moving Bitcoin off exchanges, a trend that reflects stronger confidence and a potential path toward higher price levels.

Exchange Supply Ratio Points to Reduced Selling

The Exchange Supply Ratio for Bitcoin has now returned to 0.0291. This decline shows fewer coins remain available for immediate trading on Binance. Many holders are moving Bitcoin to private storage, a clear indication of long-term positioning.

Such outflows often occur when confidence rises in broader financial conditions. A lower supply ratio suggests less selling pressure and steadier price action in the market. Bitcoin has maintained stability above 115K, signaling ongoing strength.

This pattern reflects a supportive trend for price growth. By limiting near-term selling activity, the lower ratio creates an environment where demand has greater influence, reinforcing investor outlook for sustained upward movement.

Federal Reserve Decision Drives Market Liquidity

The recent rate cut by the Federal Reserve has added liquidity to global markets. With cheaper borrowing conditions, investors tend to seek assets with stronger growth potential, and Bitcoin has emerged as a preferred option.

Liquidity support generally benefits risk assets, and the current environment is no exception. Investors are willing to pull Bitcoin off the exchanges and hold it, and this is in line with the expectations that the policy will be accommodated further.

Consequently, the pressure on sales has been reduced with the demand being strong.. The price floor above 115K has held steady, suggesting that market participants anticipate a possible target near 120K if exchange withdrawals persist.

Path Toward 120K and Reversal Signs

A continued drop in the Exchange Supply Ratio would sustain relative buying pressure. With fewer coins on exchanges, upward momentum could push Bitcoin closer to the 120K threshold in the near term.

However, a reversal in this trend would indicate caution. If investors begin returning Bitcoin to exchanges, particularly near 118K–120K, it could mark preparations for profit-taking. Such a move would signal a potential short-term ceiling.

For now, the prevailing scenario remains bullish. Liquidity from the Federal Reserve’s decision, coupled with steady exchange outflows, supports a constructive outlook. Market stability in traditional assets will help determine whether Bitcoin can extend its gains.