- Bitcoin approaches $117,500 resistance with a 2-day MACD cross forming, historically marking the start of rallies into new all-time highs.

- Spot Bitcoin ETFs recorded $642 million net inflows on Friday, extending a five-day streak and showing strong institutional investor demand.

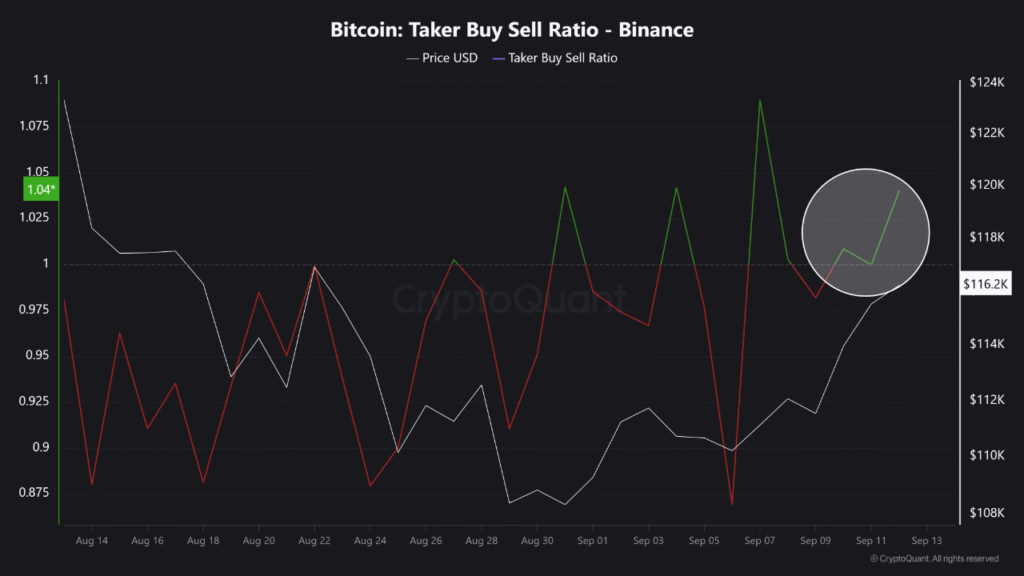

- Binance’s Taker Buy Sell Ratio stands at 1.04, with buyers dominating trades, suggesting growing trader confidence and additional room for upside.

Bitcoin is approaching an essential resistance level while a bullish MACD crossover forms on the 2-day chart. This configuration is drawing attention as traders look for a potential breakout over $117,500 that could spark a fresh rally.

Technical Indicators Show Strong Momentum

CrypFlow pointed out on X that Bitcoin is setting up for another bullish MACD cross on the 2-day timeframe. The last two times this technical signal appeared, BTC did not just rebound but quickly surged into new all-time highs.

At present, Bitcoin trades near $115,944, positioning itself close to the $117,500 level. This resistance area is widely seen as the key threshold before retesting the “Current ATH” region near $120,000. If price holds above $117,500, it may open the door to a sustained upward move.

Momentum readings also support the bullish case. The Stochastic RSI at 75 reflects strong buying interest, while the Relative Strength Index sits at 55, showing room for further gains without immediate signs of overextension.

ETF Inflows Reinforce Institutional Demand

Alongside the technical picture, strong inflows into spot Bitcoin ETFs highlight continued institutional demand. Joe Swanson reported that Friday alone saw $642 million in net inflows, extending gains for a fifth straight day. Fidelity’s FBTC led with $315 million, while BlackRock’s IBIT captured $265 million.

Spot Bitcoin ETF volumes were nearly $4 billion, reflecting higher investor participation. These figures reflect the strong support of large investors, boosting the already developing bullish technical setup on the charts.

Swanson also noted that BlackRock has reportedly considered tokenizing real-world assets and ETFs on-chain. The initiative would further extend traditional finance onto the blockchain platform and deepen markets for Bitcoin.

Exchange Activity Highlights Buyer Dominance

Exchange data adds another layer of support to the bullish outlook. Burakkesmeci observed that Binance’s Taker Buy Sell Ratio has remained positive for three consecutive days. The ratio currently stands at 1.04, indicating buyers are maintaining control over market activity.

Historically, local tops have appeared when this metric pushes above 1.15, suggesting the current reading leaves space for further price growth. With sentiment not yet overheated, the conditions remain favorable for sustained momentum.

As the world’s largest exchange shows buyers dominating sell orders, confidence among both retail and professional traders continues to grow. When paired with technical signals and institutional inflows, this strengthens the case for a potential breakout beyond $117,500.