- Bitcoin is consolidating inside the $104K–$116K zone, with $116K resistance marking the threshold for continuation or rejection.

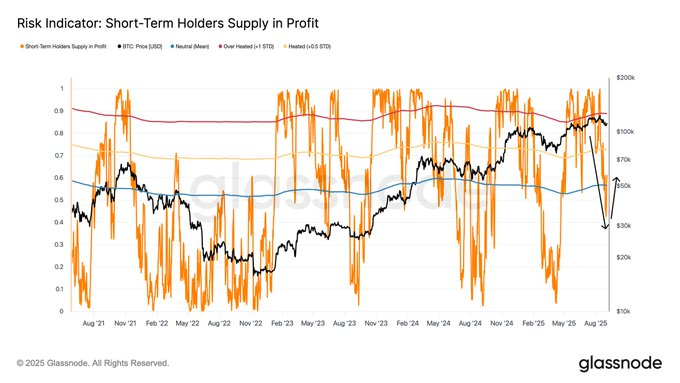

- Short-term holder profitability fell to 42% during the decline before rebounding near 60%, showing partial stabilization in positioning.

- ETF inflows slowed after driving earlier gains, leaving Bitcoin dependent on spot demand, while Ethereum inflows leaned on arbitrage strategies.

Bitcoin is stabilizing between $104,000 and $116,000 after recent investor buyer up. Futures data and ETF flows indicate cooling demand, while movement above $116,000 could extend the uptrend. A breakdown risks retesting the $93,000–$95,000 zone.

Consolidation in the $104K–$116K Zone

Glassnode reported that Bitcoin remains within the $104,000–$116,000 range. This area defines the short-term structure of the market. Resistance remains near $116,000, while potential support levels extend down toward $93,000–$95,000.

The firm noted that the latest all-time high marked the third euphoric stage of this cycle. Following that peak, the asset retraced into the 0.85–0.95 quantile cost basis. This range has historically preceded extended sideways activity before new market direction develops.

Current conditions show the market waiting for confirmation of strength above resistance or sustained weakness toward the lower boundaries.

Short-Term Holder Metrics

Data shows that short-term holder profitability dropped from more than 90% at the peak to 42% during the selloff. This reflected losses among recent buyers.

Profitability has since recovered to near 60%. The rebound indicates partial improvement in near-term positioning, though levels remain below the recent highs.

Glassnode reported that stability above $114,000–$116,000 would be required to restore stronger confidence across short-term market participants.

Sentiment and ETF Flows

Glassnode added that off-chain sentiment is cooling. Futures funding remains neutral but is vulnerable to changes in market conditions.

ETF inflows have slowed sharply. During earlier rallies, Bitcoin flows were primarily directional and driven by spot demand. Ethereum inflows included a greater share of cash-and-carry activity.

The slowdown in ETF activity indicates reduced momentum from institutional flows, leaving market participants focused on whether demand strengthens or price moves toward lower levels near $95,000.