- Bitcoin trades within the $110K–$116K range as ETF inflows slow, with derivatives activity now balancing market structure and guiding short-term momentum.

- Supply clusters at $113.8K, $112.8K, and $108.3K define critical price action, with $114K reclaim needed to return recent top-buyers into profit.

- Derivatives remain stable with futures basis below 10% and record options open interest, supporting a balanced structure amid weakening spot inflows.

Bitcoin remains caught in a tight $110,000 to $116,000 trading range as ETF inflows weaken and short-term holder activity weighs on momentum.

Bitcoin Locked in the “Air Gap”

Glassnode reported that Bitcoin has fluctuated within what it calls the “air gap” since retreating from August’s all-time high. The market movement has been declining consistently, with the cryptocurrency trapped in consolidation.

The rebound off of $107,000 resulted in dip-buying, but gains by the long-term proficient has limited positive growth. This tug-of-war has defined trading conditions throughout September.

Reclaiming $114,000 is now viewed as a decisive level. Stability above it could restore market confidence and set the stage for renewed upside.

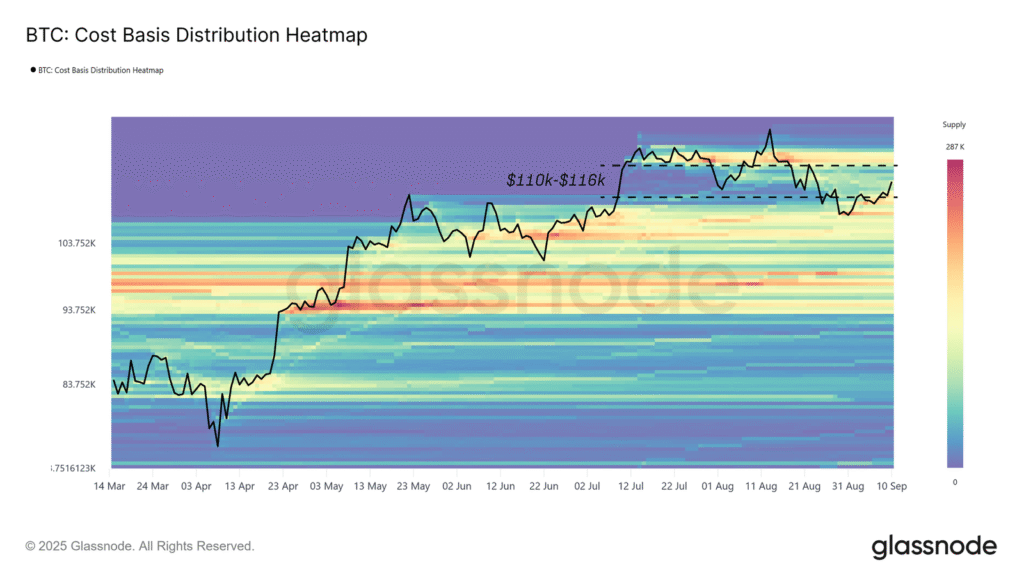

Supply Clusters Shape Market Boundaries

Data from cost basis distribution highlights three key investor groups influencing Bitcoin’s range. Top-buyers over the past three months hold positions near $113,800. Dip-buyers in the last month are concentrated around $112,800. Short-term holders from six months back are anchored at $108,300.

These clusters are currently dictating support and resistance. If the price rises above $113,800, recent top-buyers would return to profit, potentially fueling continuation higher.

However, slipping below $108,300 risks forcing short-term holders back into losses. That scenario could trigger renewed selling pressure and expose the $93,000 supply cluster as the next key downside zone.

Profit-Taking and Loss Realization

The rebound from $108,000 to $114,000 was met with strong selling from the 3–6 month holder cohort. This group realized profits of nearly $189 million per day, or around 79% of short-term gains.

Meanwhile, top-buyers within the past three months have been realizing losses of up to $152 million daily. This behavior is similar to earlier stress periods in January and April when peak buyers capitulated.

Such dynamics demonstrate that while new demand has provided stability, it has not yet been strong enough to absorb both profit-taking and loss realization fully.

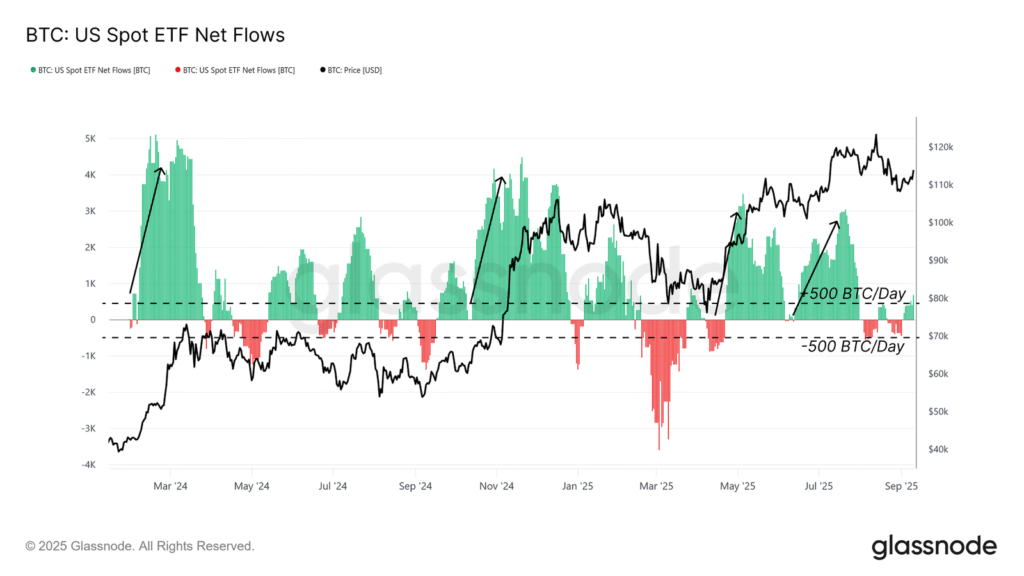

Slowing ETF Demand Weakens Structure

On-chain liquidity remains constructive, though trending lower since August. Net realized profit as a percentage of market cap has eased, reflecting waning buy-side pressure.

ETF flows, once the cornerstone of Bitcoin’s cycle, have cooled substantially. Spot ETF net flows now hover near ±500 BTC daily, far below earlier surges in March and December 2024.

The weakening of traditional finance demand has left Bitcoin more vulnerable. Without sustained ETF participation, the burden of supporting the structure shifts increasingly toward internal liquidity and derivatives markets.

Derivatives Take the Lead

As ETF inflows fade, derivatives markets are shaping the current trading environment. Futures and options now carry outsized influence, providing balance as spot flows weaken.

The futures market appears stable, with the three-month annualized basis below 10%. This reflects controlled leverage demand rather than the overheated levels often seen before corrections. Perpetual futures volumes remain muted, pointing to a healthier structure.

Options markets have reached record open interest. Institutions are relying on protective strategies, with implied volatility trending lower. This shift suggests that market participants are managing exposure more carefully, fostering steadier conditions.

Outlook Hinges on $114K Resistance

The $114,000 level has become the focal point for Bitcoin’s next move. Regaining it would bring recent top-buyers back into profit, potentially restoring momentum and attracting inflows.

If sellers continue to cap progress below this level, pressure may intensify, particularly if the price slips beneath $108,000. Such a breakdown could expose the next supply band near $93,000.

Glassnode noted that while derivatives provide balance, broader demand must return for a sustained rally. Bitcoin’s ability to hold or reclaim $114,000 will likely determine whether it consolidates for recovery or risks deeper contraction.