- BNB Chain’s TVL nearly doubled from its 2022 lows, highlighting renewed confidence and rising DeFi participation.

- Trading volume climbs 34.95% as investors re-engage with BNB’s expanding ecosystem and scaling solutions.

- opBNB and modular scaling drive cross-chain growth, reinforcing the network’s resilience and user adoption.

BNB Chain’s total value locked has surged toward the $10 billion mark, underscoring a strong rebound in DeFi activity and growing investor confidence as liquidity steadily returns to one of the largest blockchain ecosystems.

Liquidity Recovery Reflects Strengthening DeFi Ecosystem

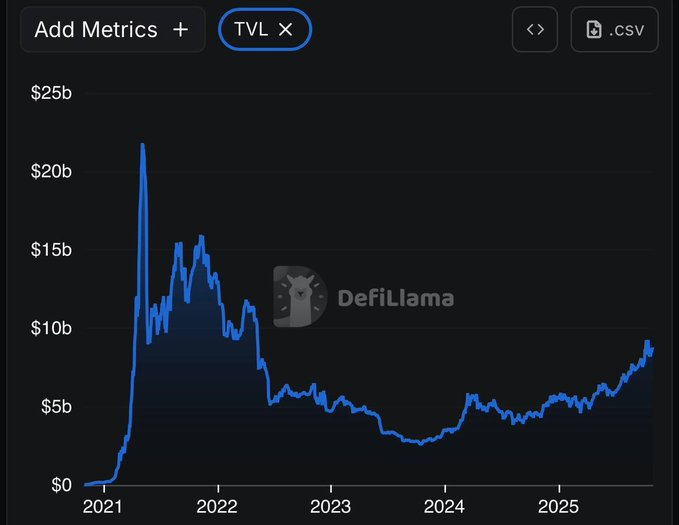

BNB Chain’s recent performance showcases a resurgence within its decentralized finance environment. Total value locked (TVL) within the chain, as reported by Cipher X (@Cipher2X), increased from under $5 billion in 2022 to nearly $10 billion in 2025. The resurge is a consistent but steady stream of liquidity and indicates elevated levels of confidence between users and developers.

The chart shared from DeFiLlama illustrates this recovery vividly, capturing BNB Chain’s cyclical growth pattern from 2021’s $20 billion peak through its steep decline and now its resurgence. After a challenging bear market, the network has stabilized and is regaining capital flows as DeFi projects regain traction. Cipher X describes this trend as “a clear sign of renewed ecosystem strength,” predicting that if momentum continues, TVL could soon test the $15 billion level — a symbolic return to full strength.

This shift highlights the market’s rotation back toward established and secure ecosystems. Centered on scalable architecture, BNB Chain attracted liquidity providers and yield farmers who base more on stable performance and sustainability over easily-gained hype cycles.

Market Performance Indicates Increased Investor Interest

At the time of writing, BNB is at $1,109.07, a 1.73% decrease in 24 hours. Even with the slight drop, market engagement has increased significantly, with trading volume increasing 34.95% to $4.8 billion. Market capitalization is at $152.76 billion and is underpinned by a circulating supply of 137.73 million BNB with a fully diluted valuation of equal magnitude — attesting there is no inflationary force.

The intraday chart shows volatility between $1,080 and $1,125, with early weakness followed by quick rebounds. These fluctuations mirror trader caution amid short-term corrections but also reveal that buyers are defending lower support zones. Increased trading activity indicates that BNB remains actively accumulated by both retail and institutional participants seeking exposure to the network’s long-term fundamentals.

BNB’s deflationary token burn continues to play a pivotal role in maintaining scarcity and price stability. The combination of high market capitalization, high liquidity, and steady user growth means that the asset is in a healthy state of consolidation before potential continuation.

Ecosystem Growth Drives Sustainable Development

The network’s expansion beyond traditional DeFi use cases continues to fuel long-term optimism. A post by PrieXt notes that “BNB isn’t just a chain, it’s a network,” emphasizing real growth through opBNB’s scaling framework and rising cross-chain interoperability. As modular scaling adapts to user demand, activity across BNB Chain protocols has accelerated, indicating a broadening adoption curve.

Increased developer participation and protocol launches reflect a maturing ecosystem capable of sustaining long-term liquidity. Cross-chain volume has also expanded, demonstrating how BNB Chain’s architecture supports efficient capital movement between decentralized applications and Layer-2 solutions. This interconnected structure positions BNB as one of the most functionally adaptive ecosystems in the DeFi space.

Cipher X’s analysis reinforces this momentum, asserting that BNB has “quietly rebuilt its foundation” while much of the market looked elsewhere. With total value locked approaching $10 billion and consistent improvements in network scalability, the chain’s revival appears driven by authentic usage rather than speculative surges. Should this organic growth persist, BNB Chain could soon reclaim its standing as a dominant force in decentralized finance.