- Spot volume growth shows consistent organic expansion with buyers dominating the 90-day CVD, reflecting broad-based accumulation across the BNB market.

- Futures markets demonstrate sustained buy pressure, supported by institutional engagement, including Franklin Templeton partnerships, balancing demand without excessive speculative leverage.

- BNB is experiencing a four-digit breakout with increased network activity, daily active users, and ecosystem adoption, which is an indicator of structural growth in the market participation.

BNB has already surpassed the 1000 mark, which indicates the presence of robust market momentum with the help of on-chain indicators. Both spot and futures market data reflect an even growth and a steady buy side throughout 2025.

Organic Spot Market Growth

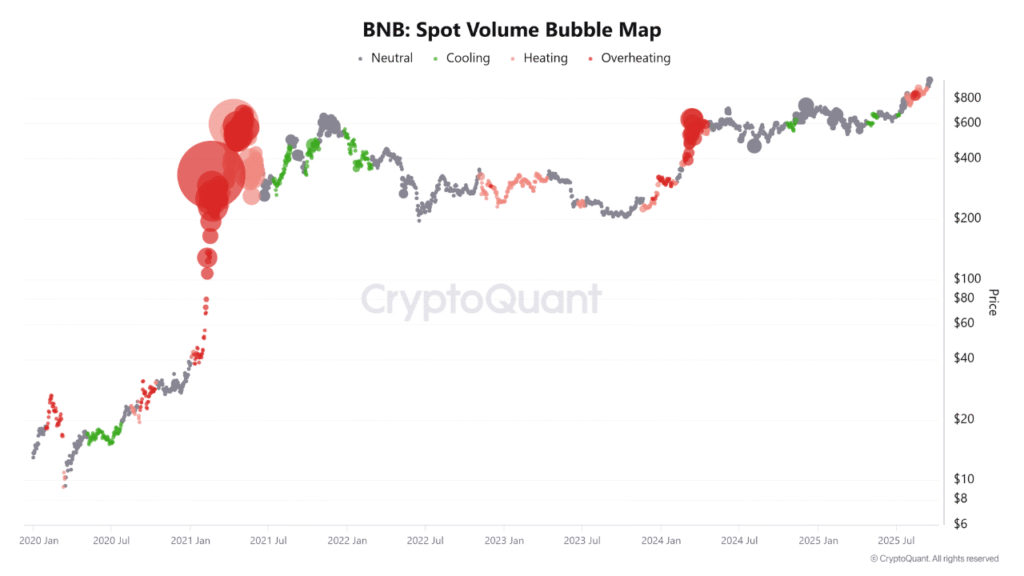

The Spot Volume Bubble Map indicates that trading volumes have expanded steadily into BNB’s breakout. Unlike previous cycles, the clusters have not reached the extreme levels observed in 2021. This suggests demand is growing naturally rather than through speculative hype.

The 90-day Spot Taker CVD highlights continuous buyer dominance throughout 2025. Market participants have maintained accumulation over an extended period, demonstrating broad-based interest in holding BNB.

Network fundamentals complement these trends, with rising daily active users, higher decentralized exchange activity, and steady stablecoin inflows. Together, these metrics confirm that spot market growth is rooted in organic adoption.

Futures Market Shows Sustained Buy Pressure

Futures data reveal that buy-side activity is returning as BNB approaches $1,000. The 90-day Futures Taker CVD shows that institutional participation is supporting market demand, rather than speculative over-leverage.

Partnerships such as Franklin Templeton’s engagement, alongside multiple Digital Asset Trading initiatives, have increased institutional involvement. This has balanced futures markets, creating stable demand around the breakout level.

The sustained accumulation in both spot and futures markets indicates that investors are supporting BNB through long-term strategies. This demonstrates a coordinated buy-side pressure that aligns with broader adoption trends.

Structural Indicators Point to Market Re-Rating

BNB’s movement to four digits reflects growing retail adoption and ecosystem utility. Buy-side trends indicated on-chain that the buying pressure is wide-ranging, and players are acquiring instead of buying and selling assets as a speculative activity.

The cumulative buy pressure, volume, and network activity are all exhibitors of structural change in market behavior. The token is demonstrating attributes beyond exchange use, signaling stronger integration into the broader crypto ecosystem.

Combined spot and futures activity confirms that the market is anchored by real demand. BNB’s growth indicates a structural re-rating supported by organic adoption, institutional interest, and consistent buy-side momentum.