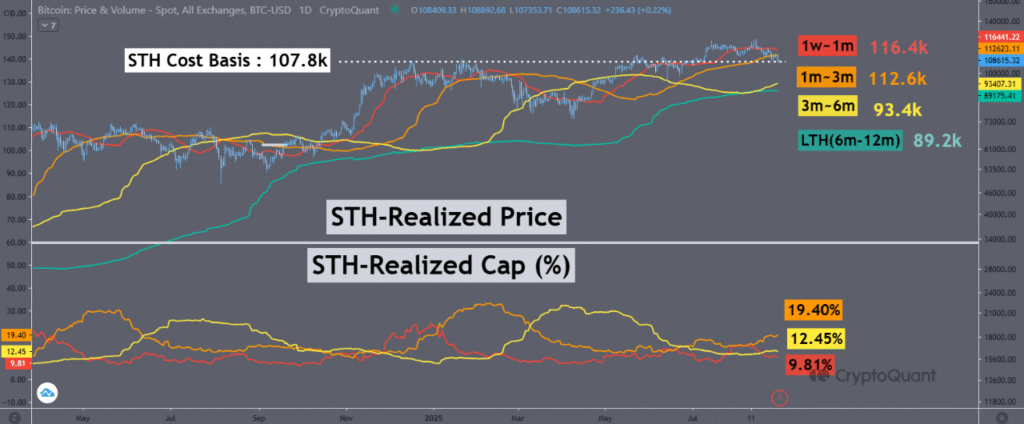

- Bitcoin trades around $108.6K with the $107.8K short-term holder cost basis emerging as a crucial benchmark for market direction.

- The $100K–$107K range aligns with short-term holders’ cost basis and the 200-day moving average, reinforcing its strength as immediate support.

- If $107.8K breaks, analysts note $93.4K as the next key support, reflecting the cost basis of 3–6 month holders.

Bitcoin is trading near $108.6k, facing pressure after retreating from its $124k peak. The $107.8k level, tied to short-term holders’ cost basis, is emerging as a crucial zone for market direction.

STH Realized Price as a Key Benchmark

The Short-Term Holder (STH) Realized Price reflects the average cost basis of recent investors, offering a critical measure of current market strength. At present, the weighted average STH cost basis stands close to $107.8k, nearly identical to Bitcoin’s current price.

Short-term holders can be grouped by holding duration. Data shows that 1–4 week holders entered around $116.4k, while 1–3 month holders are positioned near $112.6k. In contrast, 3–6 month holders acquired their coins around $93.4k, representing deeper support if the upper levels break.

If the market fails to defend $107.8k, short-term investors may be pressured to sell. This situation could add volatility and raise selling pressure across exchanges, shifting market attention toward lower support regions.

Technical Support Levels Align with Investor Behavior

This cost basis level coincides with a key technical range that has influenced Bitcoin multiple times. The $124k region, reached earlier this year, has acted as resistance in January, May, and June, creating a firm ceiling for buyers.

Below that, the $107k–$100k zone is now viewed as the nearest support, strengthened by the 200-day moving average. Market observers argue that this confluence increases the importance of defending the level where short-term holders are clustered.

Analyst Axel Adler Jr noted that below $100k, stronger support may be found around $92k–$93k. This aligns with the 3–6 month holder cost basis, marking a potential second defensive zone if pressure builds.

Market Outlook Hinges on $107.8k Threshold

Bitcoin’s ability to remain above $107.8k could be a near-term sentiment indicator for retail traders and institutional players. If maintained, the level could become a springboard for renewed efforts to break resistance at $111k- $112k.

Failure to hold the level, however, could shift focus toward the $93.4k zone. That range represents a cost basis for holders with more resilience, potentially offering a cushion if the market corrects further.

While current conditions are not viewed as overly bearish, the intersection of investor behavior and technical positioning makes this phase critical. Traders are now watching whether Bitcoin stabilizes within the $100k–$107k range or prepares for a deeper test.