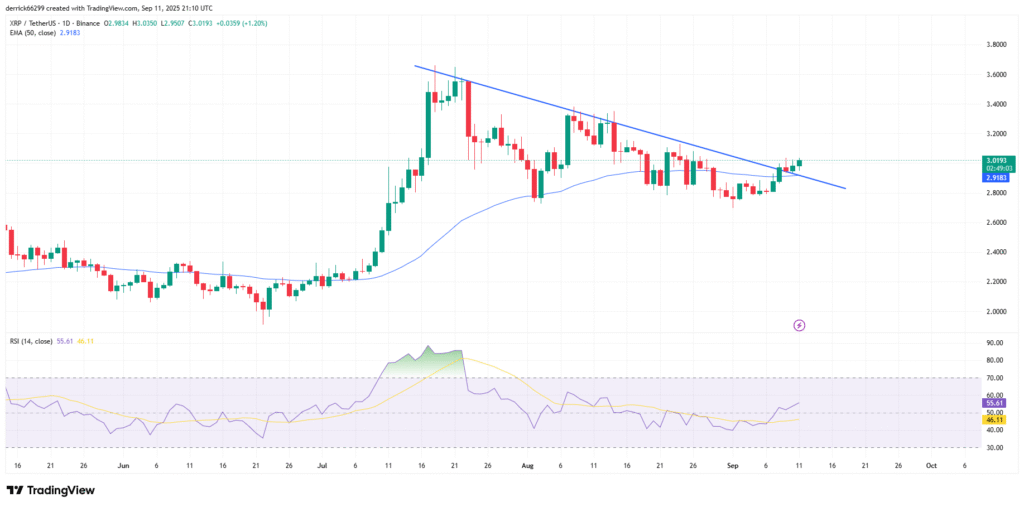

- XRP trades above $3.00 after breaking its descending trendline, with the ascending triangle apex signaling a potential bullish continuation toward $3.12.

- Long-to-short ratios on Binance and OKX indicate strong bullish positioning, showing growing trader confidence and increased exposure to potential upside moves.

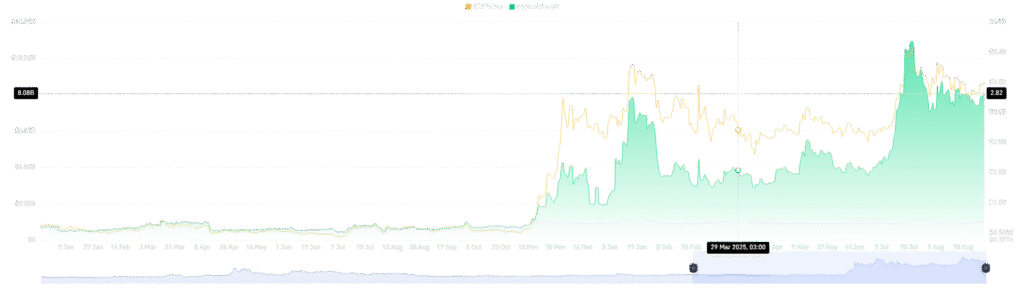

- Open interest rises to $8.23 billion despite lower trading volume, highlighting renewed derivative activity as XRP targets the $3.12 breakout level.

XRP is held above $3.00, in a pattern of a rising triangle. Technical indicators suggest the building of momentum for a breakout at $3.12.

XRP Trades Above Key Support Levels

Analyst EGRAG Crypto emphasized that XRP remains on track as long as price holds above $2.973. The ascending triangle apex positions the market for a measured target at $3.12122, with scope for extended upside if momentum strengthens.

The analyst also outlined immediate supports. The 21 EMA at $2.957 and the 100 EMA at $2.912 are the first defensive zones. A deeper test at $2.85 is described as the critical level that must hold for bullish continuation.

XRP recently staged a breakout above its descending trendline after weeks of pressure, shifting momentum back to buyers. The current price near $3.02 positions the market above the 50-day EMA at $2.91, which now serves as dynamic support.

Momentum signals remain favorable. The Relative Strength Index stands at 55.6, reflecting steady bullish energy without showing overheated conditions. Holding above $3.00 would strengthen the case for price expansion toward $3.20, $3.40, and stronger resistance at $3.60.

Market Positioning Shows Heavy Bullish Bias

Derivatives data shows renewed participation as open interest rose 3.03% to $8.11 billion. Traders are adding fresh exposure despite trading volumes falling 24.94% to $4.95 billion, reflecting a shift from short-term speculation toward committed positioning.

According to coinglass, XRP long and short ratios point to pronounced optimism. On Binance, the overall ratio sits at 2.89, while top traders show heavier bullish exposure with a ratio of 3.54. At OKX, the ratio stands at 2.29, also favoring buyers.

This tilt toward long positioning signals strong conviction but also raises the possibility of volatile swings if support levels fail. A sharp retracement could trigger liquidations, amplifying downside pressure in the short term.

However, price structure favors the bullish case. As long as XRP remains above $3.00 and maintains the ascending triangle, the path to the $3.12 breakout point remains open. Market participants closely watch these levels with the apex coming up very soon.