- Gold’s retreat from its $4,379 peak renews speculation of a Bitcoin surge similar to the 2020 market shift.

- Rising Treasury yields and Trump’s easing trade tone weigh on gold, boosting interest in risk assets.

- Traders monitor $4,098 support for gold as Bitcoin watchers anticipate a potential breakout ahead.

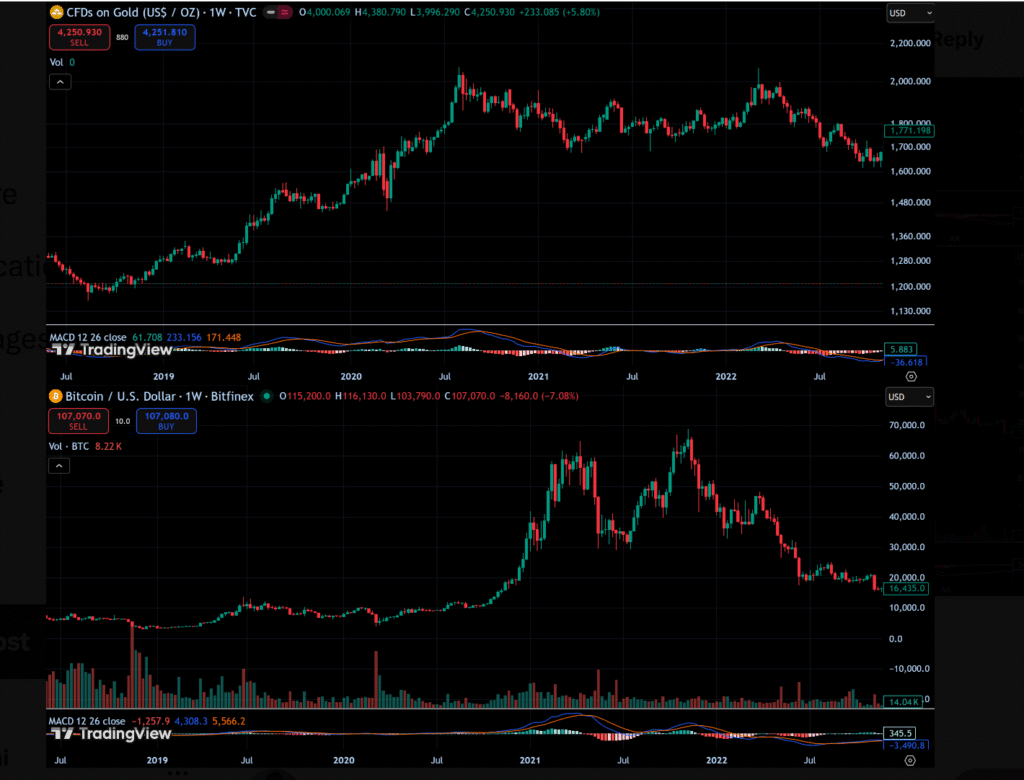

Gold prices hit a record high before retreating sharply, drawing attention from both traditional investors and cryptocurrency traders. As the precious metal’s rally pauses, some analysts suggest that a similar pattern to 2020 could be emerging, when Bitcoin began its major advance soon after gold peaked.

Gold Pulls Back After Record Surge

On Friday, gold (XAU/USD) reached an all-time high of $4,379 per ounce before falling by more than 2%. The decline followed comments from US President Donald Trump, who said that proposed triple-digit tariffs on China were unsustainable. His remarks lifted market confidence and pushed Treasury yields higher, which pressured non-yielding assets such as gold.

At the time of writing, gold traded near $4,230, down from its earlier highs. Analysts observed that the session formed a bearish pattern, with prices closing below previous lows. According to market analyst Bruce Powers, the price drop below $4,200 suggests growing resistance and could start a short-term correction. The 10-day moving average near $4,098 is viewed as a key support level, which may determine the next direction for the metal.

Traders are also watching for a possible test of this support, as the recent rally pushed gold deep into overbought territory. A close below $4,209 could confirm a bearish engulfing pattern, which often signals weakening momentum. Still, the broader uptrend remains intact, supported by continued central bank demand and geopolitical uncertainty.

Trump’s Remarks and Treasury Yields Influence Market Direction

Gold’s retreat came as risk appetite improved following Trump’s softer tone toward China. He mentioned that he would meet Chinese President Xi Jinping in South Korea in the coming weeks. This statement encouraged investors to move toward riskier assets, lifting Treasury yields and strengthening the US Dollar.

The 10-year Treasury yield rose by three basis points to 4.01%, while the US Dollar Index edged up to 98.40. Higher yields increase the opportunity cost of holding gold, leading to selling pressure in the bullion market. Federal Reserve officials also reiterated their goal of bringing inflation to 2%, though some supported the idea of a rate cut at the next policy meeting.

Despite the pullback, gold remains one of the best-performing assets of 2025, gaining more than 60% since January. The rise has been supported by strong central bank purchases, growing concerns over de-dollarization, and steady inflows into gold-backed exchange-traded funds. Analysts from HSBC recently raised their 2025 forecast for gold to an average of $3,455 per ounce and expect prices to reach $5,000 by 2026.

Bitcoin Traders Watch for Rotation Similar to 2020

BATMAN, a market analyst, drew parallels between the current gold rally and the events of 2020. When gold reached a peak of around $2,070 per ounce that year, Bitcoin soon entered a sharp upward phase, climbing from $15,000 to $67,000 in eight months.

According to this view, capital often moves from safe-haven assets like gold to higher-risk assets such as Bitcoin once gold stalls. With gold again near record highs, traders are watching for another possible rotation. However, given that Bitcoin already trades above $100,000, analysts believe the next move may take longer to develop.

The situation suggests that while gold remains a strong store of value, shifts in investor sentiment could determine where capital flows next. Both traditional and digital asset markets are likely to stay sensitive to changes in monetary policy, geopolitical tensions, and inflation trends in the months ahead.