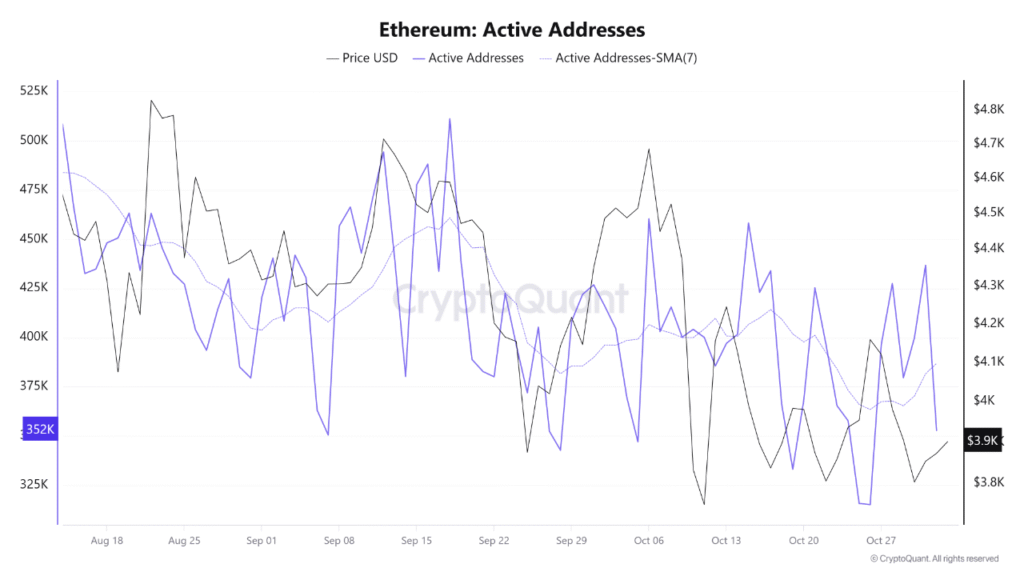

- Ethereum active addresses dropped 24% since August, showing reduced network demand and lower user interaction across decentralized applications.

- The 7-day moving average highlights a steady downward trend, matching Ethereum’s decline from $4,800 to around $3,900.

- Whale trader 0xc2a3’s $21.7 million unrealized loss mirrors ongoing market weakness across major crypto assets, including Bitcoin and Solana.

The Ethereum network is clearly showing declining activity, with daily active addresses continuing to trend downward. This is further evidence of reduced engagement with the network, and suggests reduced participation by users over the past two and a half months.

Ethereum Network Activity Shows Noticeable Decline

On-chain analysis shows that Ethereum active addresses are down nearly 24% since mid-August. The metric, which is now at approximately 363k on October 26th, down from approximately 480k, shows that interest is falling off in terms of number of users and developers. In fact, a steady contraction like this shows lower interaction with dApps, as well as injected volumes.

Looking even closer, the 7-day moving average provides an even clearer look at this trend. By removing some of the short-term noise, it shows a steady drop from approximately 480k to approximately 370k active addresses during the same time period. A clear indicator of the cooling demand on-chain.

Much like earlier periods in Ethereum history, activity on the network has always has a strong correlation with price. So as Ethereum bid dropped from about $4,800 to near $3,900, the consistent drop in a type of on-chain activity has acted in unison and is something that market participants will be watching closely.

Price Correlation Reinforces Market Weakness

Ethereum’s price action has followed the downward trajectory of its network engagement. The parallel decline between activity and valuation reinforces current bearish pressures in the broader market. As fewer participants interact with the blockchain, trading and transaction volumes remain muted.

This decline suggests a temporary pause in speculative and utility-driven activity. With lower address participation, Ethereum’s ecosystem is experiencing reduced liquidity and slower market turnover. Analysts observe that such synchronized declines often point to fragile investor sentiment.

Unless there is a meaningful rebound in active addresses, Ethereum’s recovery momentum could face resistance. Sustained growth in network participation typically precedes price stabilization, but current data reflects a cautious market atmosphere.

Whale Activity Reflects Broader Market Stress

Adding to the cautious tone, market watcher Whale Insider shared that trader 0xc2a3—previously known for a perfect 100% win rate—has incurred substantial unrealized losses. His long positions across Bitcoin, Ethereum, Solana, and Hyperliquid now show over $21.7 million in losses.

This shift marks a sharp reversal from a prior $33 million profit to a $5.8 million overall deficit. Such movements by high-profile traders often mirror prevailing market uncertainty and declining confidence in short-term bullish positions.

The confluence of decreasing Ethereum active addresses and mounting trader losses paints a picture of a market under stress. Until network engagement shows consistent recovery, price rebounds may remain limited amid broader sentiment weakness.