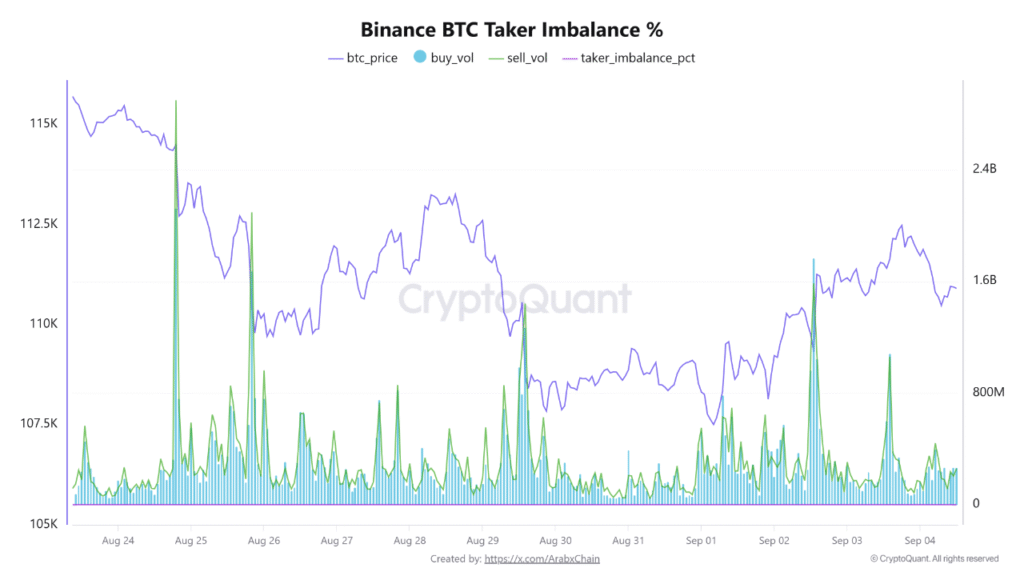

- Binance data shows Bitcoin’s buy volume surged in early September, yet resistance at $112,500 absorbed buying pressure and capped price gains.

- Short-term traders dominated market activity, boosting buying volume but limiting long-term upward momentum, keeping Bitcoin contained near $112,000.

- Hidden sell walls and historical price saturation at $112,500 prevented sustained breakouts, maintaining balance between buyers and sellers on Binance.

Bitcoin continues to face challenges in surpassing the $112,000 mark, even amid aggressive buying on Binance in early September. Data from Binance indicates that strong market orders by buyers have not yet translated into sustained price gains.

Aggressive Buying Fails to Break Resistance

At the start of September, Bitcoin rose gradually from $109,000 to $112,000, driven by increasing Taker Buy Volume on Binance. The Taker Imbalance % consistently showed a positive bias toward buyers, signaling strong market interest in purchasing Bitcoin.

Even with this positive activity, the Taker Sell Volume only decreased slightly, implying that the buying pressure was met by the current sell orders. Bitcoin faced resistance a couple of times around the price of $112,500 and could not break out decisively above it.

On September 2 and 3, Binance recorded some of the highest buy_vol peaks in the observed period. Even with this strong buying, the price remained range-bound, indicating that large sell orders or market makers absorbed most of the aggressive purchases.

Hidden Selling Caps Price Gains

One reason Bitcoin struggled despite aggressive buying is the presence of hidden sell orders. Large limit sell walls at $112,500 acted as barriers, preventing market buys from pushing prices higher. This limited the impact of increased buying volume on price action.

Another contributing factor is the nature of buyers during this period.The market was dominated by short-term traders who aimed at quick profits at the expense of long-term market positions.. This weak buyer structure limited the ability to sustain upward momentum despite high trading activity.

Price saturation near $112,500 also played a role. Historically, this level has acted as strong resistance, attracting consistent selling pressure that counteracts buying activity. As a result, even aggressive purchases struggled to move the market decisively.

Market Dynamics Reflect Balance Between Buyers and Sellers

Binance data shows that elevated buying volumes coincided with a persistent price range, reflecting a balance between buyers and sellers. Taker Imbalance % trends indicated that while buyers dominated short-term trading, selling pressure counteracted price growth.

Repeated patterns from September 1–3 demonstrated that aggressive buying led to temporary gains but could not sustain levels above $112,500. Large holders or market makers likely influenced these outcomes by absorbing buying pressure.

Traders monitoring Bitcoin on Binance observed that strong buy orders produced only limited price movement. The market continues to be sensitive to both aggressive buying and hidden sell walls, keeping Bitcoin contained near the $112,000 barrier.