- Dogecoin trades steadily near its support zone as traders await signs of a possible upward price movement.

- Rising exchange inflows suggest renewed investor confidence and early accumulation after extended market weakness.

- Analysts believe maintaining support could help DOGE regain strength and attract more bullish market activity.

Dogecoin traders are watching the $0.18 support zone closely as the cryptocurrency attempts to recover from months of selling pressure. The asset is consolidating near $0.19, with technical signals suggesting that holding this level could determine its next move.

DOGE Holds Steady After Prolonged Consolidation

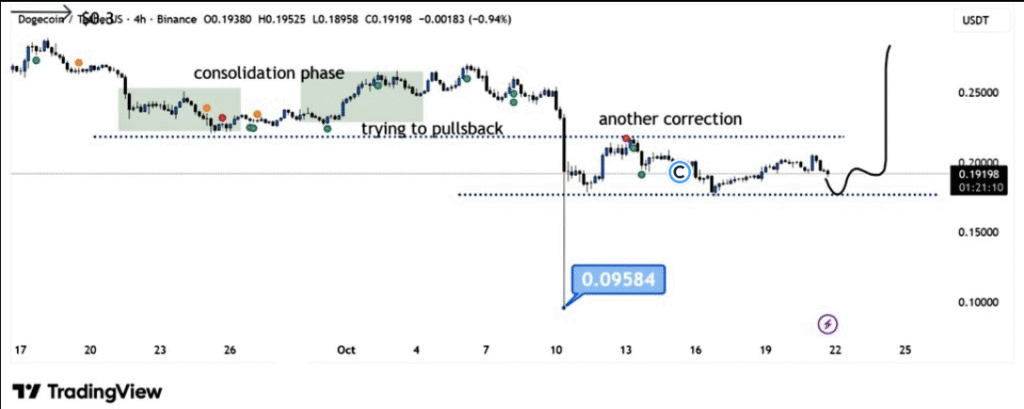

Crypto analyst BitGuru stated on X that Dogecoin looks ready for its next big move after a long consolidation phase. The analyst noted that the price is holding strong around the $0.19 zone and could target the $0.25 to $0.28 range if momentum builds. This aligns with broader technical patterns showing stabilization after a series of corrections earlier this month.

Dogecoin/TetherUS | Source: BitGuru/X

Analyst Ali Martinez also commented that Dogecoin must defend the $0.18 mark to open the path toward $0.25 or even $0.33. The token has been moving between $0.18 and $0.20 since mid-October, forming a critical base. Price charts indicate that $0.18 serves as a key floor supported by both market activity and on-chain data.

During the mid-October dip, Dogecoin briefly dropped to about $0.176 before recovering to its current range. Market watchers noted that whale transactions worth about $74 million contributed to that decline. These large movements created temporary liquidity pressures, making the $0.18 support level more important for short-term traders.

Market Indicators Suggest Potential Accumulation

According to reports, Dogecoin is consolidating at $0.1957 as exchange inflows increase to $8.46 million. This inflow may indicate that traders are starting to accumulate positions after extended selling earlier in the year. Open interest in futures has also risen to $1.73 billion, reflecting growing activity in the derivatives market.

Technical indicators show that Dogecoin is trading below its 0.236 Fibonacci retracement at $0.2025. The asset is currently positioned between several exponential moving averages, ranging from $0.1941 to $0.2238. The 20-period EMA remains the first resistance level that traders are monitoring. Breaching $0.2190 could push the price toward the 50% and 0.618 Fibonacci retracement levels at $0.2323 and $0.2457.

Market data suggests that open interest has recovered modestly after falling below $2 billion earlier in 2025. Analysts observe that when open interest increases, price bottoms are often formed, leading to directional changes. Sustained levels above $2 billion could confirm stronger market participation, while lower readings might show reduced engagement from traders.

Key Resistance and Support Levels Define DOGE Outlook

Dogecoin faces resistance at $0.21, with further targets set at $0.2190 and $0.2323. Extended upward movement could reach between $0.26 and $0.27, aligning with the 0.786 Fibonacci retracement zone. On the downside, support remains near $0.1890, followed by the established demand area around $0.1758. A clear break below $0.1750 may trigger a deeper pullback toward $0.1650.

Exchange flow data reveals a shift in trader sentiment. Dogecoin experienced negative netflows for most of the year, but recent positive inflows suggest renewed buying interest. This change coincided with the launch of KuPool, a mining pool by KuCoin that supports Dogecoin, Litecoin, and Bitcoin. The initiative aims to enhance mining stability and community engagement, potentially boosting market confidence.