- Dogecoin’s fourth bounce off a long-term support confirms buyer interest and a bullish foundation.

- A break above $0.27 could pave the way for a potential rally toward $0.30 and beyond.

- Rising on-chain metrics and growing DeFi activity add fundamental weight to DOGE’s technical setup.

Dogecoin dropped 5.5% in the last 24 hours and over 4% in the past week, falling to $0.2459. This shows market ups and downs and more selling by traders and investors.

Fourth Retest Validates Bullish Structure

Dogecoin (DOGE) is making headlines again after printing its fourth consecutive bounce off a key ascending trendline on the daily chart. The move, first noted by Crypto Spaces , reinforces a steady bullish structure that’s been developing for months.

Each time price has dipped into this zone, buyers have stepped in — and so far, history keeps repeating. This time, the bounce came right around $0.245, where DOGE found support yet again and held.

It’s the kind of chart action technical analysts like to see,a break above $0.26 to $0.27 could set the stage for a run back toward $0.30, a level that acted as resistance earlier this year.

MVRV and DeFi Fundamentals Strengthen the Case

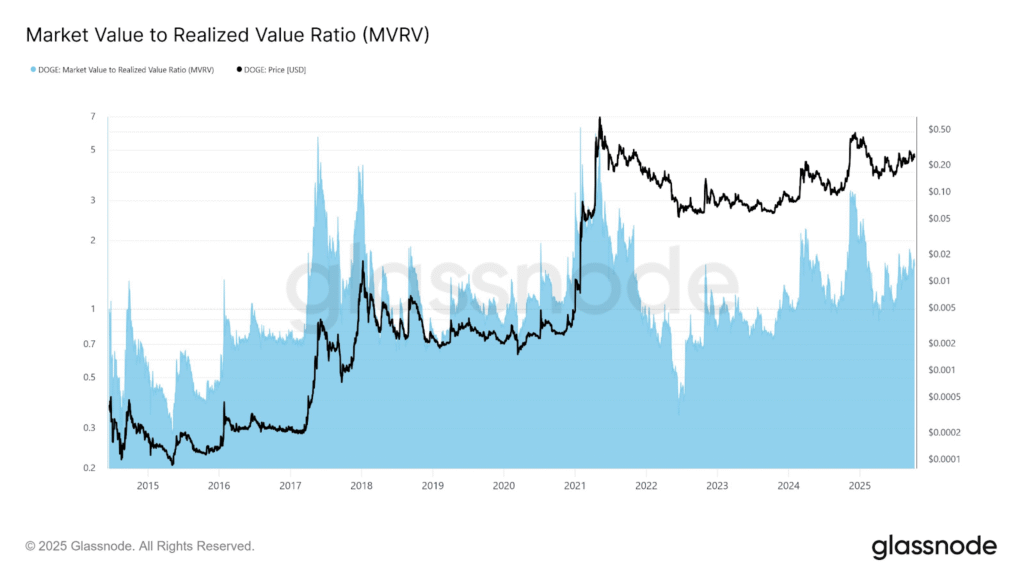

Price action isn’t the only thing going DOGE’s way. Data from Glassnode shows that the MVRV ratio — a metric for measuring investor profits — is on the rise as it sits near 2.5. This signals that many holders are back in profit.

This is important because it shows growing confidence without the kind of euphoric behavior that typically marks a blow-off rally. For context, DOGE’s MVRV hit over 5 during the peak of the 2021 hype cycle. That’s not where we are today — and that’s probably a good thing.

Meanwhile, the DeFi landscape for DOGE is evolving fast. According to DeFiLlama, Dogecoin’s Total Value Locked (TVL) in DeFi protocols jumped from under $1 million in 2022 to over $30 million earlier this year.

The bulk of that growth came in 2025, reflecting rising interest in using DOGE in more utility-focused ways — from lending protocols to staking platforms.This shift from meme coin to something more functional is giving investors new reasons to take DOGE seriously.

Mixed Sentiments

DOGE fell over 5% in the past 24 hours, with liquidations surging nearly 70%, based on Coinglass data. That kind of volatility is part of the game in crypto, but the core structure still looks solid — at least for now.

Despite the dip, DOGE still boasts a $37 billion market cap and $4.2 billion in open interest, proving that liquidity remains deep and investor interest hasn’t disappeared.

What comes next depends on whether buyers can push price above near-term resistance — and whether that fourth bounce turns out to be the launchpad for something bigger.