- Dogecoin has already tested its past trendline support, which in the past resulted in some great bullish runs, so there is a possibility of another bullish breakout in the near future.

- The daily chart indicates that Dogecoin has recaptured the 20-day EMA with a higher low formation, which indicates that Dogecoin has a high continuation potential in the near term.

- Buenos Aires accepted dogecoin as a method of paying taxes and this extends the use of dogecoin into the real world and solidifies its future as a currency beyond the effect of speculative trading alone.

Dogecoin has returned to its historical support trendline, a level that has repeatedly preceded explosive upward moves. Technical signals and adoption news now suggest the possibility of another breakout forming.

Technical Structure Points Toward Breakout

Trader Tardigrade emphasized that Dogecoin has reached its rising trendline on the weekly chart once again. This level has consistently served as dynamic support, triggering rallies after each test. In past cycles, temporary dips below the line quickly reversed, trapping sellers and fueling bullish momentum.

The chart reflects a repeated structure where brief breakdowns give way to strong recoveries. Dogecoin has already bounced above the trendline, mirroring past conditions that marked the beginning of sharp moves higher. Traders are closely watching this setup for confirmation of another cycle.

If the pattern continues, potential price targets extend to $0.40, $0.65, or beyond. To validate this outlook, Dogecoin must secure a weekly close above the support. Any sustained weakness below the trendline would challenge the bullish case.

Daily Chart Supports Bullish Case

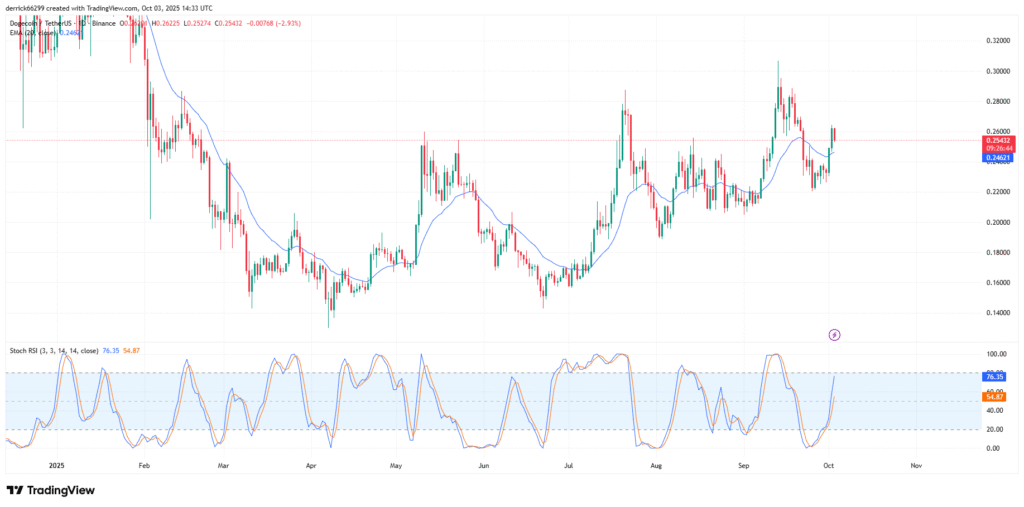

According to daily chart, Dogecoin has reclaimed the 20-day EMA at $0.2462 after rebounding from the $0.22 support.The rebound propelled price to $0.26 before minor selling pressure cut gains back to $0.2555. This shows momentum is still intact despite short-term losses.

The chart for the day is forming a higher low pattern from around mid-September, which consolidates the case for the trend to be strong. $0.265–$0.27 remains the short-term resistance that has to be broken to facilitate the next push up. Being stable above the 20 EMA is essential to continue bullish momentum.

Momentum indicators also show increasing activity. The Stochastic RSI has increased to 76.92 and it is in the overbought region. This shows a high interest in buying, even though there might be a short-lived decrease in the interest before it continues increasing.

Adoption Strengthens Long-Term Outlook

Alongside chart setups, real-world adoption adds further support to Dogecoin’s outlook. Buenos Aires recently approved Dogecoin for tax payments, expanding its use beyond speculation and into practical financial transactions.

This approval builds upon earlier efforts by businesses and institutions to integrate Dogecoin into payment systems. Each new adoption step strengthens its standing within the cryptocurrency ecosystem, offering more than just trading-driven value.

The combination of adoption growth and technical structure creates a strong backdrop for the possibility of another explosive rally. With history showing repeated recoveries from this trendline, traders are preparing for the next potential surge.