- Dogecoin sustains above the 50-week EMA with a consolidation zone between $0.18 and $0.30, signaling accumulation before a breakout.

- Analysts highlight a rising channel with impulsive rallies, projecting the next proportional move could extend toward $1.00–$1.40 levels.

- A 175 million DOGE treasury initiative by House of Doge, Dogecoin Foundation, and CleanCore adds strong ecosystem support.

Dogecoin (DOGE) is showing a strong technical setup on the weekly timeframe, with analysts projecting a potential breakout toward the $1.40 region.

Weekly Chart Builds Case for a Breakout

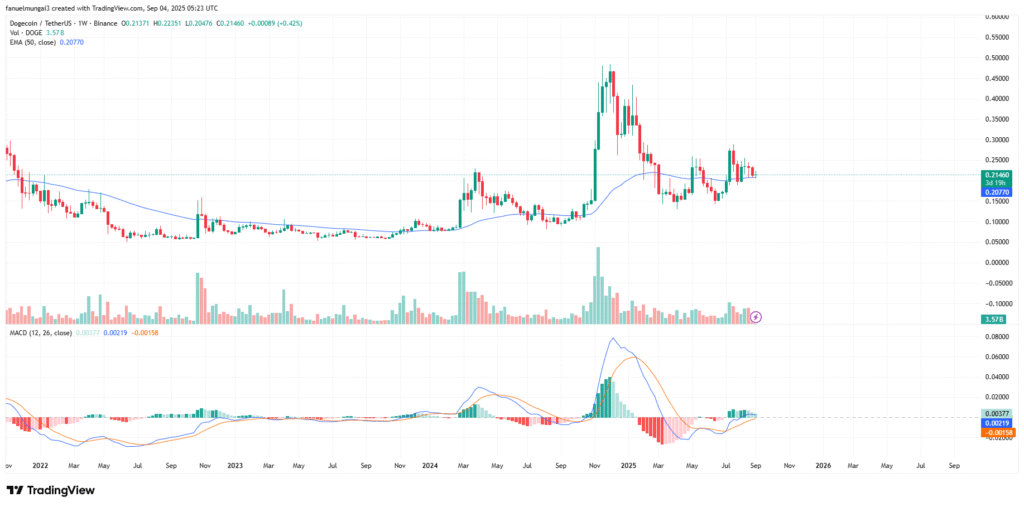

Dogecoin is trading near $0.2156, holding slightly above the 50-week EMA at $0.2077, a level acting as key support. The current consolidation zone between $0.18 and $0.30 suggests accumulation after the sharp 2024 rally that topped above $0.55.

Analysis from Bitcoinsensus points to a logarithmic rising channel on the weekly chart, where DOGE continues to respect its lower rail. Each impulsive move within the structure has exceeded the last, fueling projections that the next advance could stretch to $1.00–$1.40

Previous thrusts in the pattern saw DOGE climb to $0.23 with nearly 290% gains, followed by a larger rally to $0.50 with 440% upside. The same fractal behavior, if repeated, implies a move targeting the upper band of the channel.

Technical Indicators Signal Momentum Recovery

The weekly setup highlights that a sustained break above $0.25–$0.30 would confirm bullish continuation. Clearing this range would open the door for upside targets at $0.35 and later $0.45–$0.55, levels that align with prior market supply.

Momentum indicators are also aligning with the technical structure. The MACD has gone positive, and the blue line crosses over the signal line and the histogram changes to green. In the past, such a momentum change in the weekly time has been followed by robust rallies.

DOGE’s ability to hold above the 50-week EMA signals buyers remain in control of the trend. A breakdown below $0.18 could weaken the structure, while a loss of the lower rail near $0.15 would invalidate the bullish thesis. Until then, the setup shows signs of stored energy within the channel.

Ecosystem Development Strengthens Market Context

Alongside technical progress, Dogecoin is gaining support through ecosystem initiatives. The House of Doge, Dogecoin Foundation, and CleanCore Solutions recently unveiled a 175 million DOGE treasury program, adding to the project’s market narrative.

Liquidity levels above $0.23–$0.25 remain thin, meaning that a decisive break through this range could accelerate price action toward $0.30 and beyond. Bitcoinsensus notes that reclaiming this zone would be a critical trigger for larger moves.

Invalidation of the breakout scenario remains defined. A weekly close back below $0.17–$0.18 would weaken the outlook, while a loss of the channel’s structure near $0.15 would cancel projections toward the $1–$1.40 zone. For now, the weekly chart continues to show conditions favoring a potential breakout.