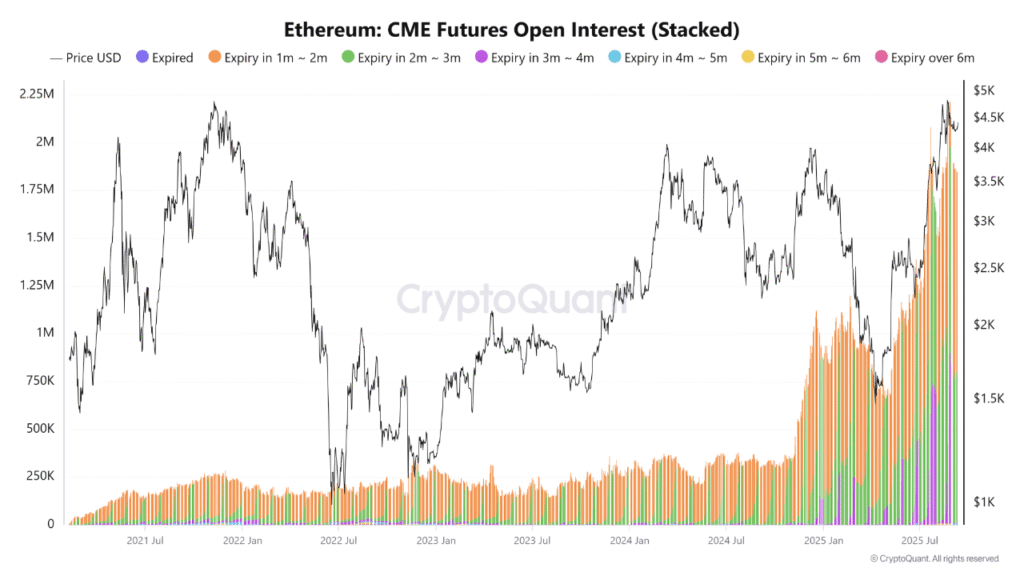

- CME futures open interest has reached all-time highs, with short-term maturities dominating as institutions aggressively expand exposure to Ethereum.

- Rising participation in three to six-month contracts reflects growing institutional confidence, supporting Ethereum’s price momentum beyond the immediate trading horizon.

Ethereum is trading around the $5,000 mark as record-high institutional futures demand and open interest suggest that a move toward resistance at $6,800 may be on the horizon.

Ethereum is trading around the $5,000 mark as CME futures open interest reaches all-time highs, and institutional demand expands, creating pressure for further upside.

Record CME Futures Open Interest Aligns With Ethereum’s Surge

Ethereum’s climb toward $5,000 is being supported by record activity on CME futures. PelinayPA reports that open interest has surged, with short-term maturities between one and three months dominating. This positioning reflects aggressive institutional participation as ETH retests its all-time high levels.

In 2021 and 2022, futures activity on CME remained limited. Open interest was relatively low, and contracts were mostly short term. Ethereum’s price gained momentum during that cycle, but institutions kept exposure muted, focusing on shorter strategies.

As the 2022 bear market transpired, open interest dropped drastically as the prices dropped. Involvement in institutions diminished, and the long-term maturities were subdued. This phase marked a period of reduced confidence in Ethereum derivatives.

By 2023 and 2024, however, open interest began to recover. Contracts diversified into maturities of three to six months, reflecting renewed demand as Ethereum steadily climbed. That trend has now accelerated, with 2025 bringing record open interest across CME futures markets.

Institutional FOMO Shapes Ethereum’s Path Toward $6,800

The current surge shows a strong concentration in short-term maturities. This creates elevated volatility during contract expirations, where unwinding and leveraged adjustments often spark rapid price movements. Ethereum has already seen sharper intraday swings as a result of this structure.

Alongside the short-term buildup, long-term contracts are also attracting more participation. Rising interest in maturities beyond three months signals institutional confidence in Ethereum’s trajectory. This shift suggests that investors are looking beyond immediate trading strategies toward sustained exposure.

PelinayPA noted that Ethereum’s rally to the $4,500–$5,000 range with record CME futures open interest shows institutional FOMO in action. This level of engagement has made derivatives trading a key driver of the current bull market.

Ethereum’s ability to maintain momentum will depend on how institutions manage their leveraged positions. While liquidation risks remain elevated, analysts see room for further gains. If demand continues at the current pace, Ethereum could potentially reach the $6,800 resistance level before year end.