- Ethereum’s transition to Proof-of-Stake ended miner sell pressure, replacing it with staking dynamics that now control liquidity and circulating supply.

- EIP-1559 burns and increased network usage have introduced a deflationary framework, making Ethereum’s supply mechanics structurally different from its mining era.

- Ethereum trades near $4,300 with $4,800 as resistance, and a confirmed breakout may trigger upside targets between $6,000 and $7,000.

Ethereum’s transition to Proof-of-Stake has eliminated a long-standing source of market pressure: miner sales. With supply now shaped by staking and token burns, attention turns to price levels near $4,800, the last major barrier before higher targets.

Mining Era Ends With the Merge

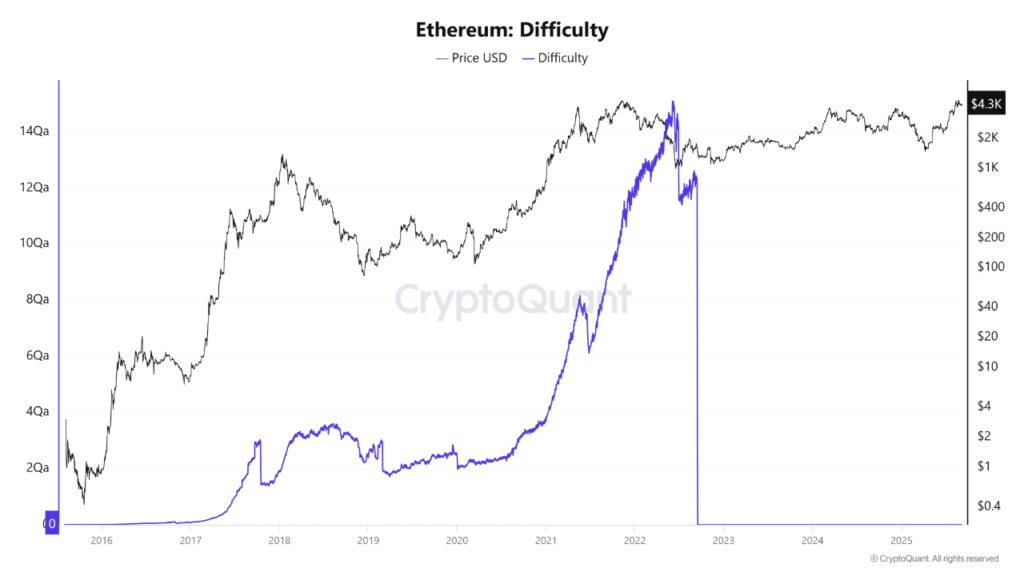

For years, Ethereum’s price rose in tandem with mining difficulty. When the market advanced, more miners joined, boosting security and reinforcing the network. Both metrics reached their highest point in the 2021 bull run.

The following year marked a turning point. The Difficulty Bomb, also known as the Ice Age, pushed difficulty sharply higher as Ethereum prepared to abandon Proof-of-Work. This was designed to gradually slow mining activity ahead of the Merge.

Once the Merge was complete, mining ceased and difficulty fell to zero. That single change removed a steady stream of sell pressure from miners, leaving Ethereum’s supply shaped by staking and transaction activity instead.

Scarcity Through Staking and Burns

With Proof-of-Stake now running the network, large amounts of ETH remain locked in validator contracts. This reduces circulating supply and limits liquidity on exchanges.

Ethereum also benefits from its burn mechanism under EIP-1559. Each transaction removes a fraction of ETH permanently from circulation. When network activity rises, this effect becomes stronger, supporting scarcity.

Staking and fee burning together naturally create a self-reinforcing mechanism for Ethereum. Unlike Bitcoin’s halving, which takes place at a set interval, Ethereum’s deflationary bias tends to happen at the point in time in which there is high demand and increased transaction volume.

Market Outlook and Key Levels

Ethereum has consistently bounced back from its 2022 low of around $1,200, trading at about $4,331 as of this writing, this represents a 1.16% price increase in the last 24 hours. With no miner sell-offs to pressure the market, price increase has been encouraged by institutional demand and new financial instruments like ETFs.

Adoption is also expanding through Layer-2 solutions including Arbitrum, Optimism, and Base. These networks reduce costs, improve scalability, and drive further use of Ethereum for decentralized finance and other applications.

Attention turns to $4,800, Ethereum’s record high. A break above this level would pave the way for a move to $6,000–$7,000 levels. Support on the downside at $3,600–$3,800 remains key to supporting an uptrend.