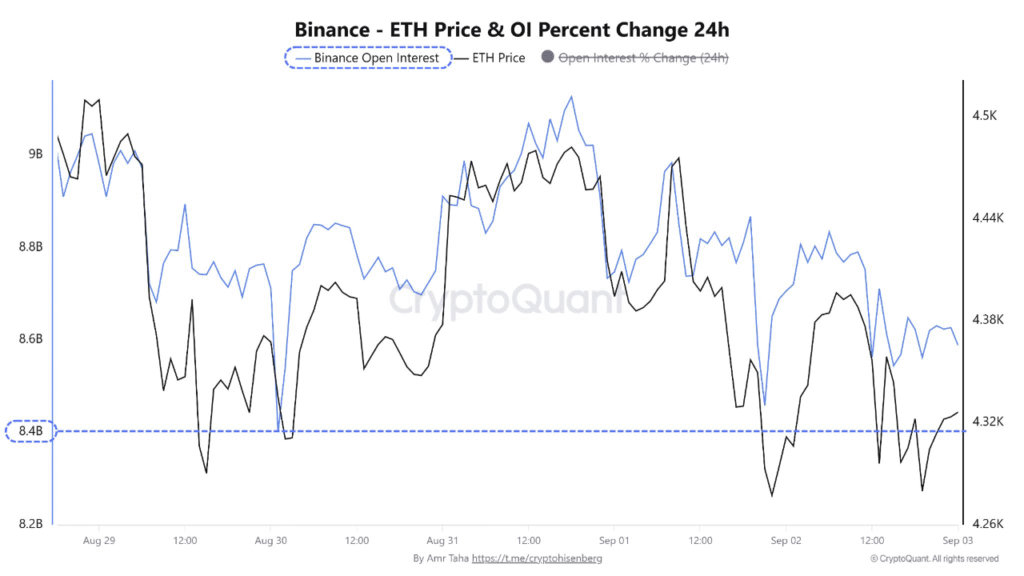

- Ethereum open interest on Binance remains above $8.4B, reflecting traders maintaining exposure despite price dips below $4,300 this week.

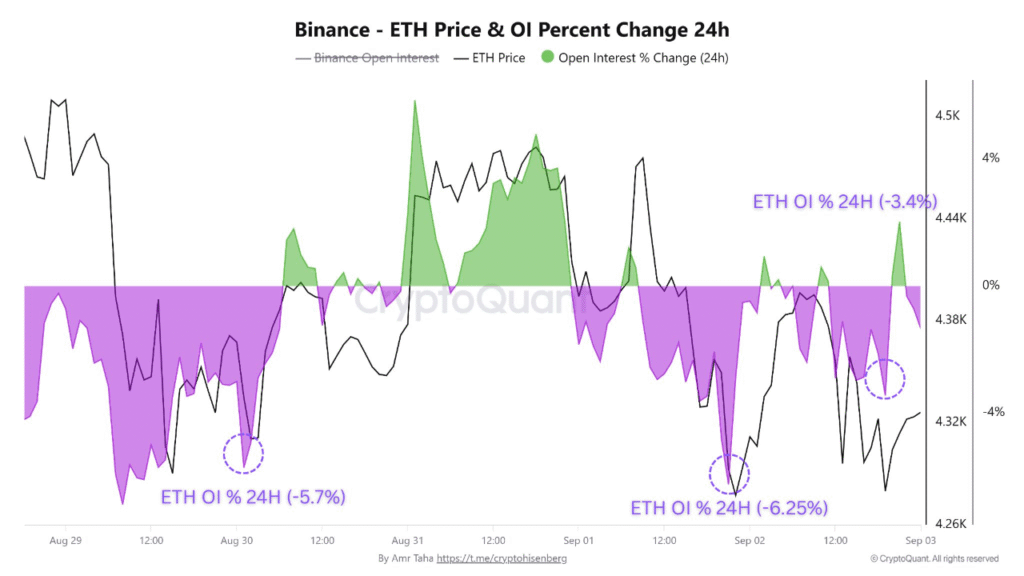

- Binance’s open interest contraction slowed to -3.4% from -6.25%, showing stabilization in derivatives markets and reduced aggressive unwinding activity.

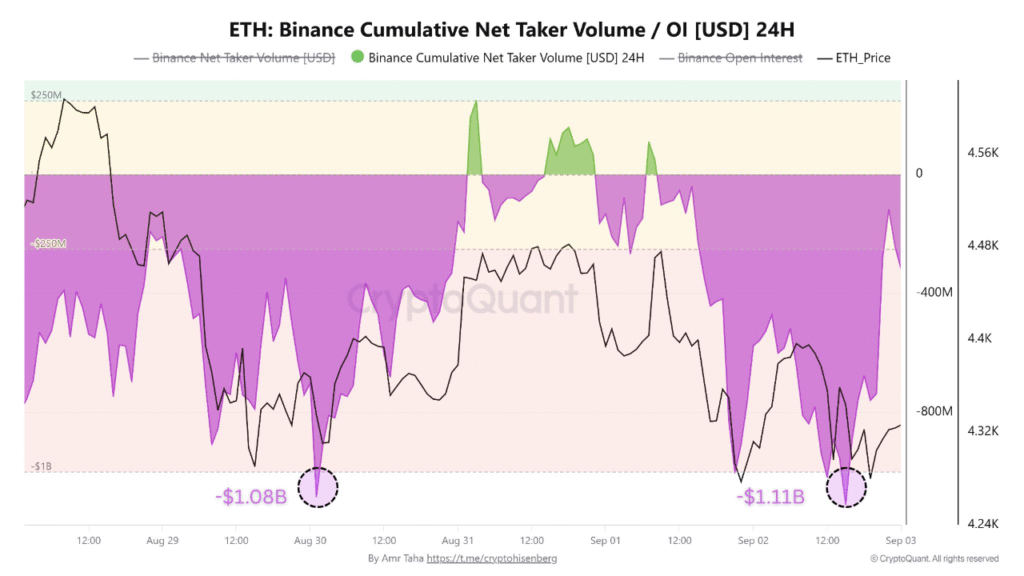

- Persistent negative Net Taker Volume contrasts with steady Ethereum withdrawals from exchanges, tightening supply and supporting structural resilience within current market conditions.

Ethereum open interest on Binance has stayed above $8.4 billion despite recent price declines, raising questions about whether traders are signaling resilience. The unusual stability comes at a time when selling pressure dominates derivatives markets.

Ethereum Open Interest Defies Price Weakness

Data shows that Binance’s Ethereum open interest failed to break decisively below $8.4 billion, even after ETH dipped under $4,300 this week. Normally, such price declines are accompanied by reductions in open interest as traders liquidate positions or exit risk.

The persistence of open interest suggests participants are maintaining exposure rather than rapidly cutting back. This pattern may indicate traders are expecting eventual recovery or are unwilling to unwind positions in anticipation of further downside.

In contrast to typical behavior during strong retracements, the current open interest stability reflects a market structure where positions remain largely intact. This may point to a more resilient stance by traders, limiting the scale of liquidation-driven volatility.

Moderation in Open Interest Contraction

According to market updates, the 24-hour percentage change in Binance open interest fell by -3.4%. This was a softer decline compared to the -6.25% drop seen two days earlier.

The slower contraction suggests the sharp deleveraging phase is subsiding. Initially, Ethereum’s price decline coincided with a heavy drop in open interest, reflecting fast risk reduction. However, the recent moderation indicates that selling pressure in derivatives markets is no longer accelerating.

Such behavior signals that aggressive unwinding has cooled. While open interest is slightly lower, its stabilization shows that traders are refraining from adding downward pressure through mass liquidations. This strengthens the argument for potential resilience within the current market environment.

Persistent Selling Pressure Balanced by Withdrawals

Despite stable open interest, Binance Net Taker Volume has remained negative, ranging from -1.08 billion to -1.11 billion in recent sessions. This indicates aggressive sellers are active, pushing consistent downside pressure across derivatives trading.

Yet, the fact that open interest has not collapsed shows that counterparties are still present to absorb part of this activity. Instead of an exodus, traders appear to be maintaining or even repositioning, limiting deeper imbalances.

Meanwhile, spot exchange flows add another dimension. Statistics indicate that Ethereum is currently seeing regular withdrawals surpassing 120,000 ETH per day via platforms like Binance and Kraken. Such withdrawals decrease the exchange reserves, constraining both sell-side liquidity and reducing available supply in a structural manner.

Whether linked to accumulation or custodial reallocation, these consistent outflows provide a bullish undertone. They introduce an element of reduced spot market depth, helping counter persistent negative sentiment in derivatives markets.

At the time of reporting, Ethereum trades at $4,405.11, showing a 0.54% increase over the past 24 hours and 0.42% gains over the week.