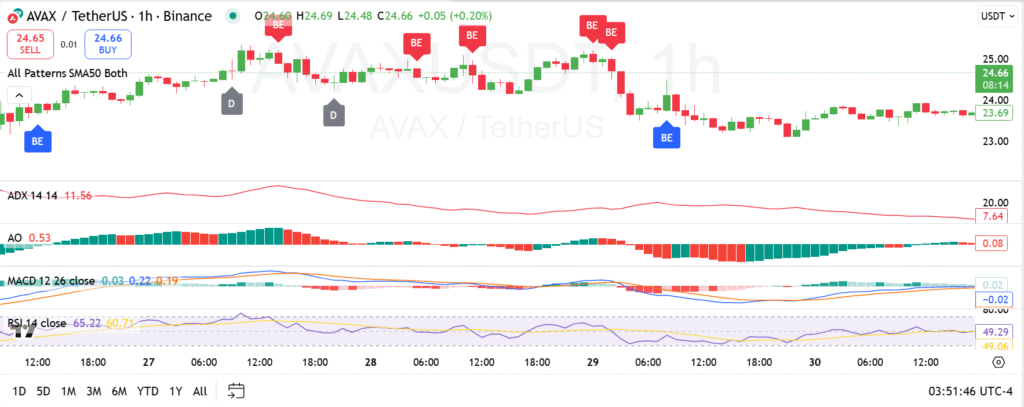

- AVAX Price MACD crossover across the signal line indicates the bearish momentum has changed to bullish momentum in the 1-hour chart.

- The 49.29 RSI indicates a neutral state of the market with a possible increase.

- The weak trend strength of 7.64 indicates the presence of a consolidating or a trading range market at ADX.

Avax price is displaying some of the initial indications of a potential reversal of direction following recent price rejection around the $27 mark. The asset that is currently trading at $24.62 attempts to recover after hitting a local minimum at $23.69. Since key indicators are now beginning to reflect the shift in tone, traders are seeing whether this is the start of a bigger pullback or a temporary rebound.

Mixed Technical Signals Raise Uncertainty Around AVAX Price Direction

AVAX price has been recording a slight rise in the most recent 1-hour candle and is up by 0.04%. This is after a downtrend of consolidation. In the last time up, bearish engulfing patterns have emerged around the swing highs with many resulting in additional drops. In the recent past, a bullish engulfing pattern has developed following a rebound at 23.69, which can be an indication of potential early signs of interest in buyers coming back.

Regardless of this, the move is not well-confirmed. AVAX price is currently around the 50-period Simple Moving Average (SMA) which suggests that it holds a neutral to slightly bullish position. Assuming the price will be able to remain higher than that, it may sustain further upside efforts. But gains can be but momentary without more powerful impulse.

ADX (Average Directional Index) is currently at 7.64, which is lower than 11.56. This decrease indicates that there is low trend strength and the market is not trending with momentum. Weak ADX is a sign of uncertainty and the price movement is more apt to follow an up-down movement or in very minor swings.

The Awesome Oscillator (AO) has entered the green region a notch higher as it has a value of 0.08. This indicates a premature buyer push, although the tendency is still mild. This concept is also supported by MACD data, where the MACD line is slightly above the signal line. The crossover is technically discovered to be bullish yet the momentum is nearer to neutral.

The RSI stands at 49.29, which is slightly less than 50. There are no overbought or oversold conditions in this level. It has come up out of bottom, a sign that purchasing interest is coming back slowly.

Volume stands at 1.24% to $1.80 billion, and open interest is increased by 6.40% to $884.94 million. These increasing numbers are an indication that there are increasing numbers of traders venturing into the market. AVAX price was unable to break and pullback continued at another level when it reached the $25 mark and then the pullback further strengthened. AVAX price could break above 25 and then possibly hit the 27 level as a near-term ceiling again.