- Shark purchases amounted to 65,000 BTC, now owning 3.65 million BTC, which can be seen as a good accumulation level at around the same price of $112,000.

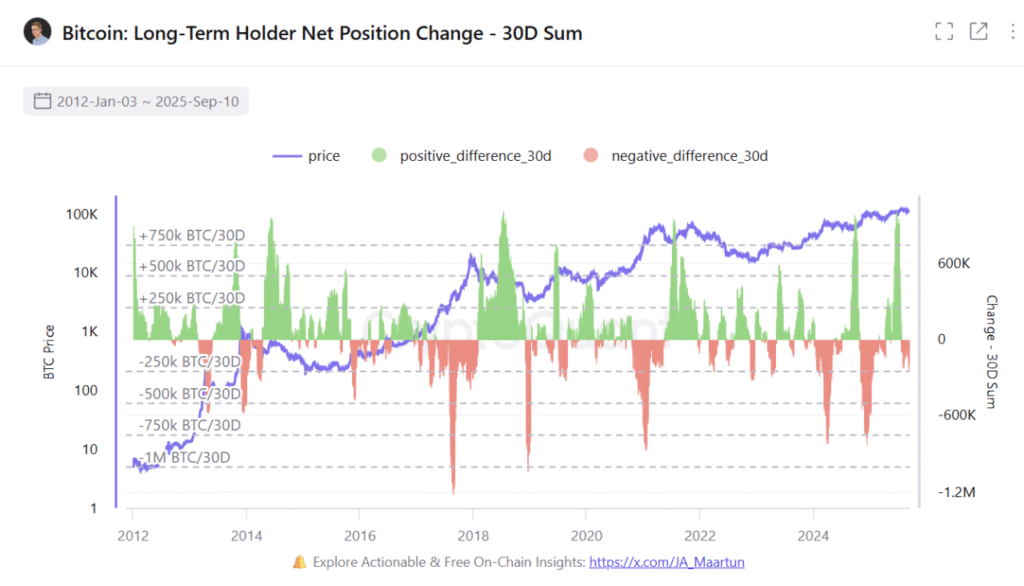

- Long-Term Holder Net Position Change shows experienced investors absorbing supply, reducing available Bitcoin for trading across exchanges.

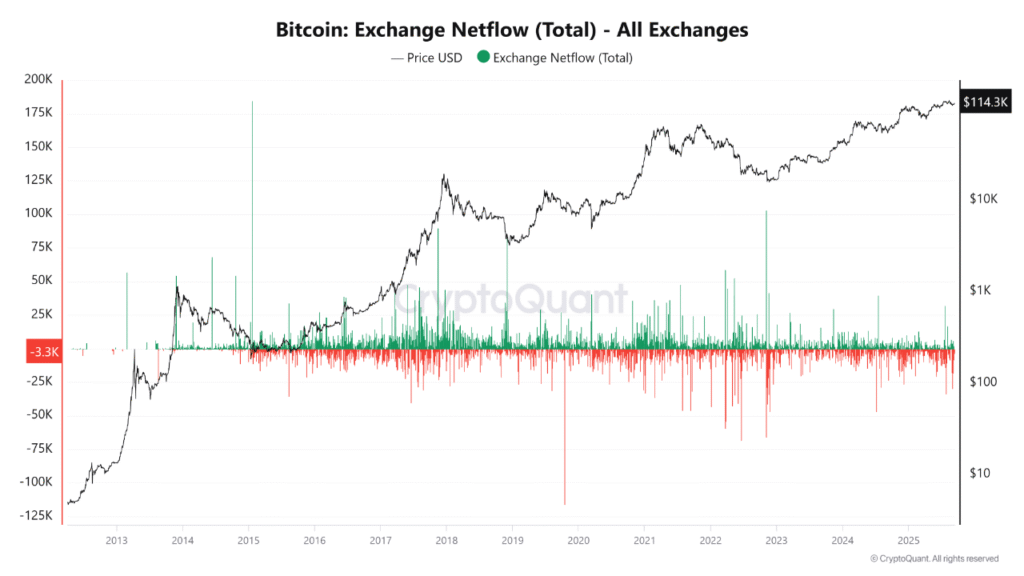

- Exchange netflows indicate persistent BTC withdrawals, moving coins to cold storage and creating conditions for tighter market supply.

Bitcoin shows a divergence between short-term traders and larger holders as “shark” addresses accumulated 65,000 BTC in just seven days. This brought total holdings to a record 3.65 million BTC, even as prices hovered near $112,000.

Long-Term Holders Increase Accumulation

Long-Term Holder (LTH) Net Position Change, which tracks 30-day balance shifts among experienced holders, has turned strongly positive. Green spikes indicate that long-term holders are acquiring Bitcoin instead of distributing it.

Periods of rising LTH accumulation often precede market rallies. Coins in strong hands remain off exchanges, reducing available supply and reinforcing structural demand.

This trend highlights a separation between retail participants and experienced investors. While short-term traders respond to price swings, LTHs continue absorbing supply steadily.

Exchange Netflows Show Persistent Withdrawals

Exchange Netflow data confirms the accumulation trend. BTC withdrawals from exchanges have dominated recently, signaling coins are moving to cold storage rather than staying liquid for trading.

Outflows align with LTH buying patterns, indicating that accumulation is removing supply from the market. The data points to strategic holding rather than speculative trading.

Reduced exchange balances suggest market liquidity may tighten if demand increases. Persistent outflows combined with strong hands absorbing supply could create structural conditions for higher prices.

Shark Buying Signals Structural Demand

Addresses holding 100–1,000 BTC, often called “sharks,” added 65,000 BTC over seven days. Their total holdings now stand at 3.65 million BTC, a record high, indicating conviction-driven accumulation.

Shark activity complements LTH and exchange netflow trends. Both datasets show coins leaving active circulation, suggesting supply is becoming less available for trading.

This combination of accumulation and persistent withdrawals points to a potential supply squeeze forming. While short-term corrections may occur, the structural trend shows that larger holders are reducing available market supply.