- ETH breaks $4K resistance for first time since 2022, confirming bullish breakout.

- Ethereum options volume up 29.27%, signaling growing speculative interest.

- $226M liquidated in 24h — $212M from longs — showing sharp volatility despite bullish bias.

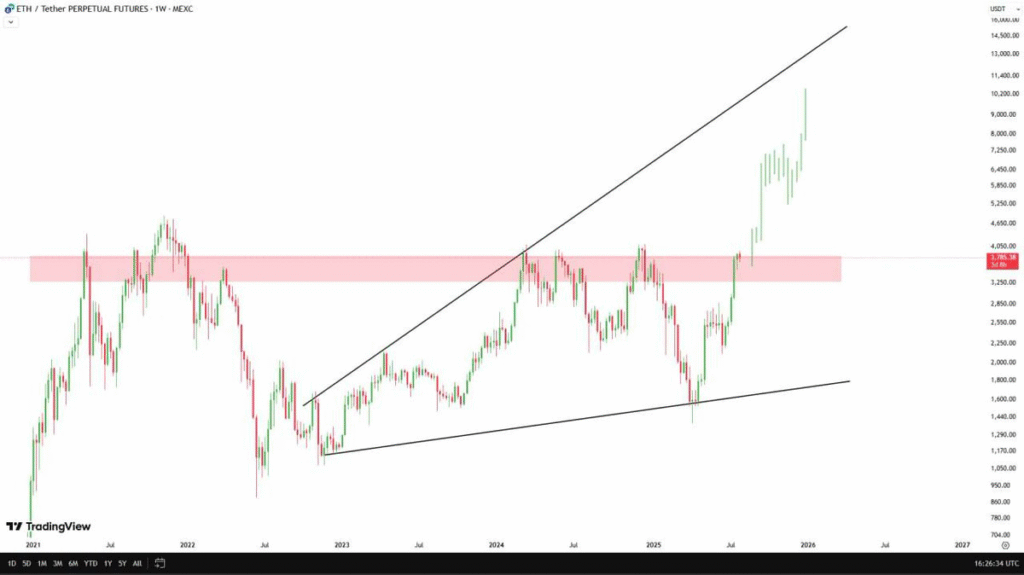

Ethereum price has broken above the $4,000 level for the first time since 2022, confirming a major bullish breakout. Strong technical patterns, rising volume, and increasing speculative interest are pointing to growing momentum. Per the analysts, ETH price could be preparing for a parabolic move toward $8,000 as market structure continues to support the uptrend.

Ethereum Price Breaks Above Multi-Year Resistance

Ethereum price is trading at $3,630.62, down 5.86% on the day after a steady decline from the $3,864 open. The price action has been cleanly bearish, forming lower highs and lower lows throughout the session.

The move reflects strong selling pressure, and if momentum continues, ETH could test support near the $3,550 level in the short term. Despite the short-term weakness, Ethereum’s broader trend remains bullish. ETH recently broke above the key $4,000 resistance, which had capped price action since 2022.

Crypto analyst Marcus Corvinus has pointed to a breakout from a bearish widening wedge, a rare but powerful signal, especially when paired with sustained accumulation. He views this as a convergence of structure, psychology, and timing, setting an ambitious cycle target between $7,000 and $8,000.

Adding further strength to the long-term bullish outlook, Ethereum price has also cleared an ascending triangle that’s been developing since 2022. With support now firming around the $4,000 level and a rising trendline still intact, the current dip may simply be a technical pullback.

Market Data Shows Mixed Signals

As per Coinglass, ETH derivatives trading volume rose 22.73% to reach $124.77 billion. Options volume also increased by 29.27%, though open interest in options fell by 9.35%. This may suggest older positions are closing while new short-term positions are opening.

The decline in futures open interest of 5.22% could be a market reflection of either profit-taking, or de-leveraging. Ratios of long positions to short positions on such exchanges as Binance and OKX are extremely biased in favor of long positions. Binance data indicates that position ratio is 3.06, whereas OKX indicates 1.83.

Source: CoinGlass

Within the last 24 hours, $226 million in liquidations took place with the most $212 million of the liquidations being the long position. This demonstrates that although the bets on the upward trend are prevailing, liquidations are occurring as a result of short-term volatility.

Read Also:

BlackRock’s Ethereum ETF Hits $4B Monthly Inflow