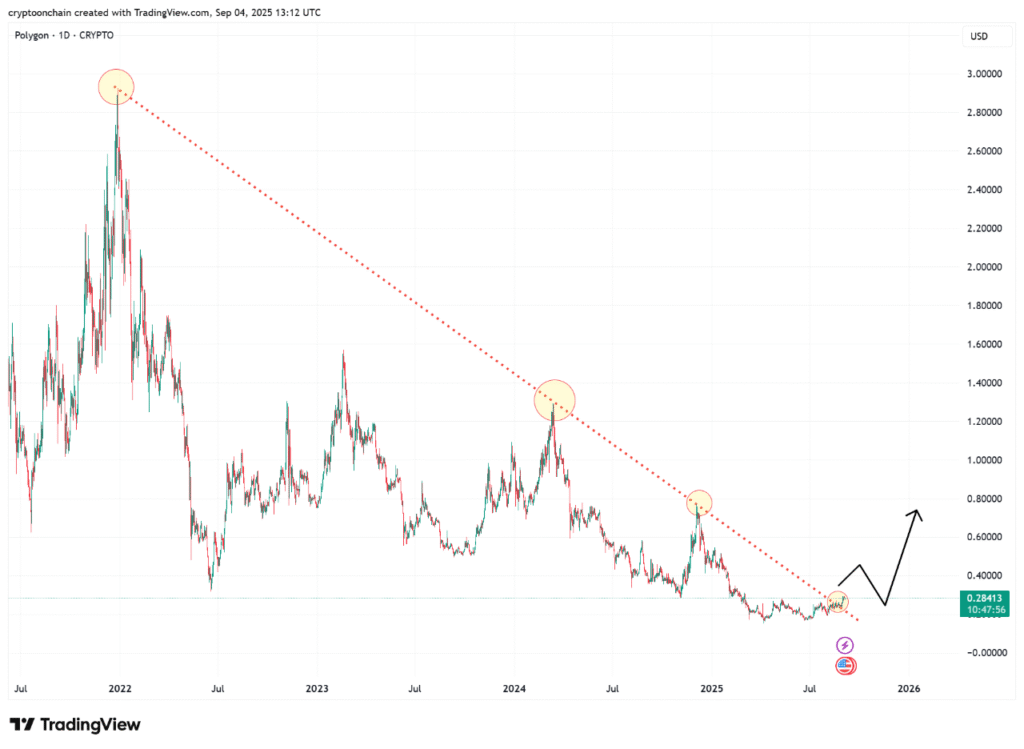

- Polygon’s price is testing a long-term descending trendline at $0.284, with traders watching for a confirmed breakout above resistance.

- Network activity reached a one-year peak as the 30-day average transactions hit 3.9 million, reflecting sustained user participation growth.

- Daily transactions reached 4.4 million for the first time since July 2024, indicative of heightened uptake and increased underlying dan monetary support for the network.

Polygon is at a pivotal crossroads as price negotiates a major resistance and network activity is at a year-long high. The alignment of these conditions has drawn strong interest from market analysts.

Price Holds at Long-Term Resistance

MATIC has been struggling under a descending trendline that has persisted since December 2021. This ceiling blocked upward attempts on March 13 and May 12, 2024, keeping the token locked in a prolonged downtrend. On September 4, 2025, the asset trades near $0.284.

The current retest is viewed as critical by traders. A daily close above the $0.284 threshold could break the long-term resistance. Market attention remains centered on whether this structure will finally give way after nearly four years of pressure.

At this stage, the price trajectory offers limited middle ground. A breakout may fuel momentum toward a higher range, while rejection could extend the existing consolidation pattern further. Closing levels are seen as the key confirmation for either scenario.

Network Activity Climbs to New Highs

Alongside the technical setup, Polygon’s ecosystem is experiencing a notable increase in activity. On-chain statistics reveal a strong rise in user transactions and sustained participation across the network.

The 30-day simple moving average of transaction counts now sits at 3.9 million. This represents the highest level recorded in the last year, pointing to consistent network usage beyond short-term volatility.

Daily transactions have exceeded 4.4 million, which was not seen since July 2024, and implies a level of engagement in the chain has returned, showing structural basis which may allow price to move to the resistance levels.

Can Network Demand Support a Breakout?

The convergence of strong on-chain metrics and technical positioning has created a pivotal moment. Polygon is testing its resistance while showing signs of healthy ecosystem growth. Together, these signals raise questions about whether demand can provide the final push.

A breakout above $0.284 would not rely solely on speculative flows. Instead, it would coincide with one of the strongest network participation surges in more than a year. Such alignment often strengthens the durability of upward moves.

Analysts continue to monitor both the chart and the data closely. Should MATIC sustain a close above its barrier, the price action and on-chain growth would mark a decisive moment for Polygon’s trajectory.