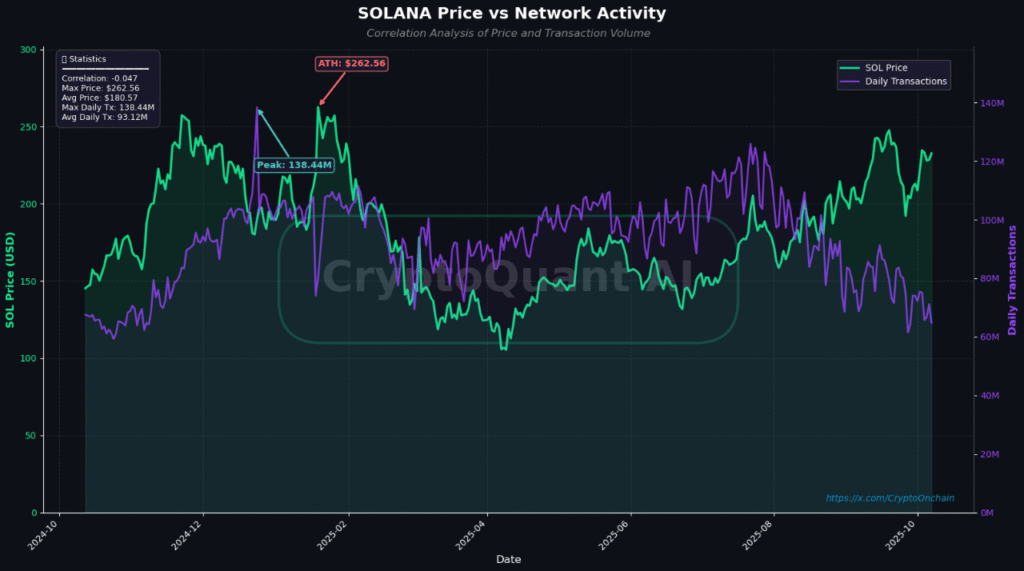

- Solana’s daily transactions have dropped from 125 million to 64 million, showing a 50% decline amid a continuing price surge.

- Analysts highlight the need to separate validator “voting” activity from real user transactions to gauge actual network demand.

- Despite reduced activity, Solana trades above $228 as bullish traders eye a potential breakout toward the $1,300 technical target.

The rally from Solana is continuing to impress traders, however, a closer look at the blockchain’s on-chain data shows a troubling situation. Although the price of SOL continues to rise, the network is seeing a sharp decline in activity—calling into question how sustainable this uptick actually is.

Transactions Fall as Prices Climb

Recent data shows Solana’s daily transaction count has fallen from around 125 million on July 24, 2025, to roughly 64 million today. That’s a drop of nearly half, occurring right as SOL’s price has been pushing higher.

Normally, strong price growth is supported by more users joining the network and more transactions taking place. This time, the opposite seems true. Solana’s rising price alongside declining network activity suggests that much of the current excitement may be coming from traders and speculators rather than genuine usage within its ecosystem.

Given that a blockchain built its name on high throughput and active use in DeFi and NFTs, a significant drop in transactions will raise questions. Analysts will wonder whether this rally is really built on hype rather than true long-term demand for the technology.

Are Fewer Users or Validators Behind the Decline?

Not all Solana transactions are equal. Most of them—roughly 80% to 90%—come from “voting” transactions used by validators to keep the network running. These are not user actions like trading tokens or minting NFTs.

So, the key question is: what kind of transactions are falling? If the drop mainly comes from validator votes, it could simply be a result of protocol changes or technical updates, not a real slowdown in activity. But if the decline is happening in user-driven transactions—those that reflect genuine economic activity—it would cast doubt on the strength of Solana’s recent rally.

Analysts are watching closely to see whether this is a short-term fluctuation or a sign that fewer users are engaging with Solana’s DeFi platforms, NFT markets, and applications.

Price Strength Meets Network Weakness

Despite the fall in transactions, SOL’s market performance remains strong. The token trades around $228.94, with a 24-hour trading volume of $7.48 billion, showing a 2.85% daily and 4.56% weekly gain.

Market analyst Ali (@ali_charts) noted, “Solana $SOL looks like it’s breaking out of a cup and handle. If confirmed, the pattern points to $1,300.” That kind of technical optimism has kept sentiment high, even as on-chain data tells a different story.

Solana’s price surge may continue in the short term, but the nearly 50% drop in transactions puts its long-term momentum into question. Whether this rally can hold will depend on whether real network usage begins to recover—or if the market is simply running ahead of the fundamentals.