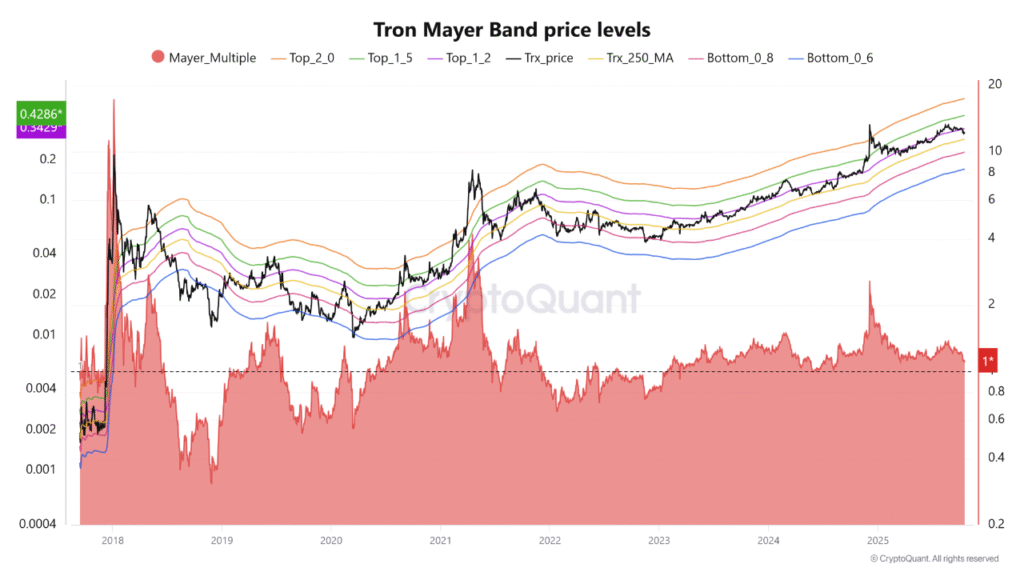

- TRON’s successful defense of the 250-Day Moving Average confirms a stable accumulation phase and reinforces investor confidence in long-term market structure.

- The Mayer Multiple (MM 1.0) level remains the defining support zone, validating renewed bullish momentum and psychological assurance among TRX holders.

- Persistent trading above the 250D MA signifies structural strength, suggesting TRX’s willingness to continue higher from a more solid foundation of its market.

TRON (TRX) is showing new market vitality following its capacity to stay above the Mayer Multiple (MM) 1.0 line, which is the 250-Day Moving Average (250D MA). This long-term technical defense suggests stability and confidence returning to the asset’s broader structure.

TRX Holds Firm Above Key Technical Level

TRX has established a critical support area near its 250D MA, which now stands at $0.2857, while the token trades around $0.3131. The repeated defense of this level indicates that market participants view this metric as a cornerstone in TRX’s ongoing price formation.

The Mayer Multiple, a long-standing gauge of long-term price positioning, often serves as a psychological and technical pivot for market behavior. When the MM 1.0 level holds, it reflects strong accumulation by market participants, confirming that buyers remain active around the historical average cost basis.

Market observers note that this defense has often preceded trend reversals or renewed upward momentum. In this instance, TRX’s bounce from near the 250D MA suggests a well-supported structure capable of sustaining further strength.

Confirmation of Accumulation and Market Transition

The price interaction around this moving average confirms renewed market confidence. Historically, when TRX maintains stability near the 250D MA, it signals the transition from corrective movements to structured accumulation.

Analysts interpret the present setup as a shift from hesitation to constructive market rebuilding. The consistent price behavior near the MM 1.0 level supports this transition, signaling that the asset is maintaining equilibrium before potential expansion.

A tweet from Crazzyblockk noted that “TRX has successfully validated the Mayer Multiple 1.0 zone, confirming strength and readiness for upward positioning.” Such observations reinforce the perception that this level serves as both technical and psychological reinforcement.

As TRX continues trading above the 250D MA, the narrative transitions toward sustained structural stability. The formation of this base provides a platform from which the asset may continue building momentum in the coming sessions. By holding above the long-term average, TRX reaffirms its resilience and its capacity to maintain a firm technical posture in the current market cycle.