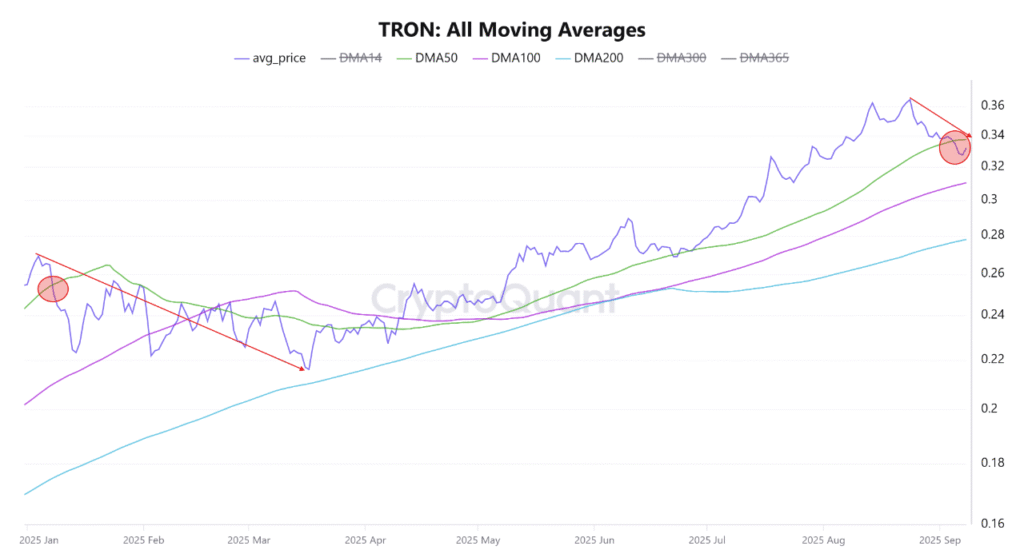

- TRX dropped under SMA50 at $0.33, shifting attention to SMA100 at $0.31 and SMA200 support at $0.27 for direction.

- Analyst burakkesmeci highlighted losing SMA50 as a trigger for prior declines, stressing $0.27 support as the key threshold for sustaining momentum.

- TRON Inc. expanded treasury holdings to 677,596,945 TRX after $210 million purchases, reflecting structured accumulation at an average cost of $0.3099.

$TRX has slipped below its SMA50 at $0.33, a move that raises questions on whether $0.27 can hold as the critical support level. Traders are now carefully observing both SMA100 and SMA200 zones to assess the possibility of a deeper correction or stabilization.

SMA50 Breakdown Shifts Market Focus to $0.27

Analyst burakkesmeci emphasized that SMA50 is often the first moving average used to track short-term momentum. In an earlier 2025 breakdown, Tron lost SMA50 and later declined from $0.25 to $0.21. The current move below $0.33 has therefore drawn closer attention to lower support zones.

With SMA50 now acting as resistance, $0.33 becomes the immediate barrier for any recovery attempt. Below that level, SMA100 at $0.31 is the first cushion. If sellers continue to dominate, the next line of defense is SMA200, anchored at $0.27.

The $0.27 level now serves as the critical threshold for the broader uptrend. Sustaining above it could provide a foundation for $TRX to stabilize before attempting to reclaim higher averages. A failure to hold this zone could open the path for a deeper pullback, extending the market’s corrective phase.

Momentum remains balanced, reflecting indecision. Market participants continue to evaluate whether accumulation will occur near SMA200 or whether bearish pressure will push the price into new territory.

Treasury Accumulation Brings Additional Market Attention

While technical levels dominate short-term analysis, institutional activity has added another factor. On September 2, 2025, maartunn reported that TRON Inc. expanded its treasury by acquiring 312,500,100 TRX at an average price of $0.2739. The purchase, valued at $110 million, came only three months after the company’s last allocation.

In June 2025, TRON Inc. had secured 365,096,845 TRX at the same entry price, investing $100 million. Combined, these acquisitions bring the total holdings to 677,596,945 TRX, with a blended acquisition cost of approximately $0.3099.

Unlike most corporations that diversify into Bitcoin or Ethereum, TRON Inc. has concentrated exclusively on building reserves of its native token. This approach reflects a long-term strategy centered on its ecosystem, even as $TRX tests critical technical support zones.

With $210 million deployed across two quarters, the treasury expansion offers a firm backdrop for $TRX. Whether this accumulation provides additional stability during the current test of $0.27 remains a key question for market participants monitoring the token’s resilience.