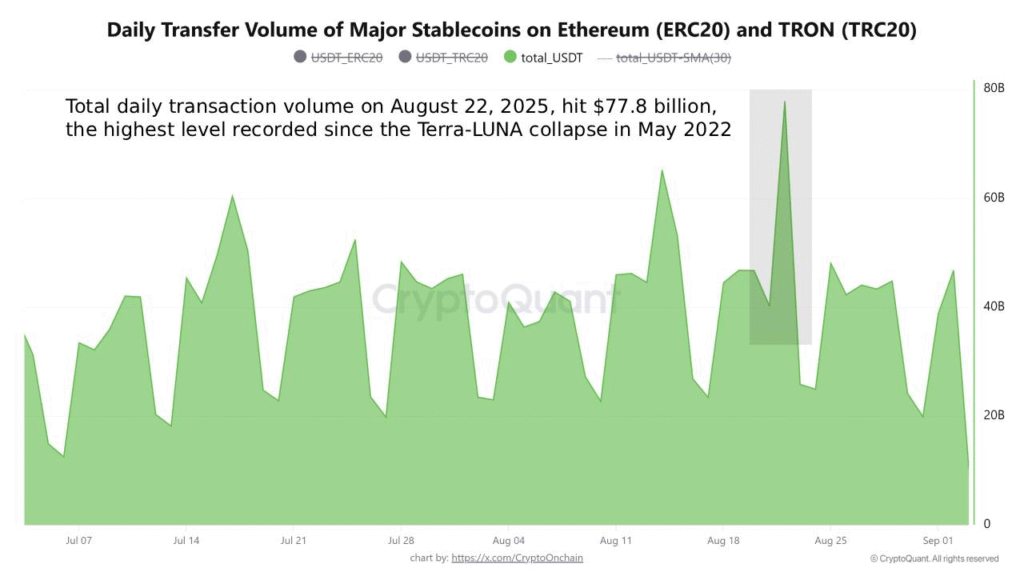

- The 30-day moving average of USDT transaction volume reached a record high, showing steady demand for dollar-backed liquidity across networks.

- USDT daily volume was reaching high of 77.8 billion on August 22, 2025, the highest since 2022, which shows high transaction momentum.

- TRON and Ethereum networks continue to drive USDT adoption, highlighting its role as a central channel for liquidity in global markets.

USDT cross-chain activity has accelerated to unprecedented levels, with its 30-day moving average of transaction volume reaching a record high. Daily transactions also peaked at $77.8 billion on August 22, 2025, marking the strongest reading since 2022.

30-Day Moving Average Signals Strength

The 30-day moving average of USDT transaction volume now stands at an all-time high across Ethereum and TRON. This measure smooths daily swings and points toward a steady and persistent rise in stablecoin usage. Such growth suggests deeper reliance on USDT within global digital asset markets.

Unlike earlier short-lived spikes, the sustained uptrend indicates continuous adoption. This consistency reflects ongoing demand for liquidity rather than event-driven flows. Market participants continue using USDT to secure dollar-based value across exchanges, lending platforms, and decentralized protocols.

Ethereum remains a key network for larger flows, but TRON’s cost-efficient framework has attracted a considerable portion of high-frequency transactions. Together, the networks demonstrate USDT’s dual appeal across institutional and retail users.

Daily Volume Surpasses Historical Benchmark

The USDT registered daily transactions worth of \$77.8 billion on August 22, 2025. It is the most active point in the history since the LUNA crisis of May 2022. At that point, panic-driven exits from volatile assets inflated volume levels dramatically.

The current market backdrop differs significantly. This surge comes during relative stability, with no widespread liquidation events. Analysts view the development as evidence of liquidity preparation, where large holders accumulate stable reserves rather than exiting in fear.

Commentary across crypto channels has compared the rise to “smart money positioning.” Observers point out that the latest increase has occurred gradually, aligning more with deliberate accumulation than sudden flight.

Market Braces for Heightened Volatility

The acceleration of USDT activity offers several interpretations for traders. One view suggests that whales are positioning to deploy capital in upcoming opportunities. Such preparation often precedes sharp movements in asset prices.

Another explanation is growing global demand for stablecoins. USDT has cemented itself as a primary instrument for moving liquidity across borders. TRON’s low transaction costs have particularly boosted adoption in regions seeking fast, inexpensive settlements.

As volumes reach historic levels, the crypto market is looking like it is about to enter a turbulent time. Analysts suggest that we need to pay attention to liquidity trends because the activity that USDT achieves all-time highs could be the lead-up to a breakout phase.