- The 2025 cycle peak of Bitcoin is estimated to be 130K to 176K, according to the Fibonacci levels and the recent increasing channel formation.

- A resounding breakout of over 120K will allow the cycle to move towards greater heights, which is in tandem with the past Fibonacci actions and known technical trends.

- Liquidation data shows $1.5B risk at $130K and $15B at $105K, underscoring market pressure near key resistance levels.

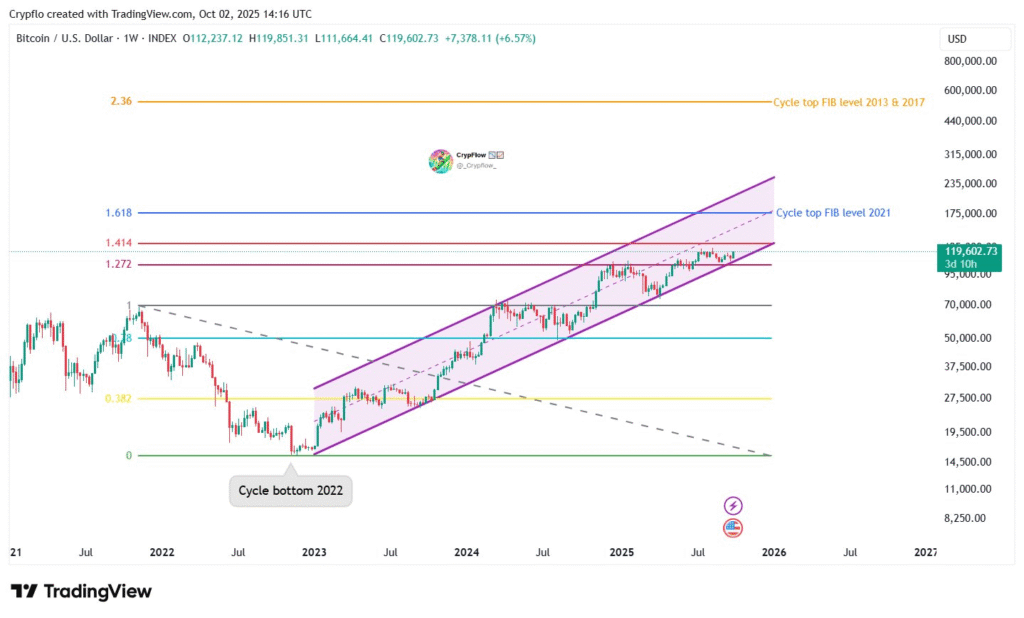

Bitcoin has continued its climb inside a rising weekly channel since bottoming in late 2022, with price now approaching the key resistance cluster near $120,000. Analysts are now turning to Fibonacci levels to outline potential cycle tops in 2025.

Rising Channel and Fibonacci Projections

The Bitcoin 1W chart shows a steady structure of higher lows and consistent rebounds from the channel’s lower boundary. The asset is now trading close to $119,600, testing the 1.272 and 1.414 Fibonacci levels, which form a major resistance zone.

Historical behavior reveals Fibonacci projections as reliable roadmaps for cycle peaks. In both 2013 and 2017, Bitcoin topped at the 2.36 Fib extension, which would now equal a staggering $538,000 target. While technically valid, this figure appears distant from present market conditions.

In 2021, however, Bitcoin hit the 1.618 Fib, projecting a more realistic target this cycle of $176,000. This also aligns with the upper resistance of the present rising channel, further establishing its technical importance in 2025 projections.

Two Scenarios for 2025 Peak

CrypFlow shared that two scenarios dominate the current outlook. The former case is a recurrence of 2021, with Bitcoin surging towards the 1.618 Fibonacci level around the 176,000 mark. This would mark a continuation of prior cycle structure and proportional growth.

The second scenario focuses on diminishing returns, suggesting the peak could arrive earlier near $130,000. This zone aligns with the 1.414 Fibonacci level, just above present resistance, and would confirm the idea of a gradually maturing market.

Both scenarios require a decisive breakout above $120,000 to validate. Once cleared, Bitcoin could either push toward $176,000 at the channel’s top or settle into a more modest peak around $130,000.

Liquidations Add Another Layer

Market liquidation risks bring another factor into the discussion. Analyst Ted highlighted that a move toward $130,000 could trigger approximately $1.5 billion in liquidations. A sharper correction to $105,000 could see as much as $15 billion liquidated.

These figures underline the volatility expected as Bitcoin nears its breakout point. Traders and institutions face increasing exposure, with heavy liquidation clusters sitting just above and below the current range.

With price pressing against resistance at $119,600, the balance between Fibonacci projections and liquidation pressures sets the stage for the next breakout. Whether Bitcoin tops near $130,000 or stretches to $176,000, the path above $120,000 appears critical for 2025 cycle progression.