- TRX trades at $0.338 with buyers targeting a $0.351 reclaim as resistance caps gains and support rests near $0.321.

- Tron’s network fee reduction of 60% strengthens competitiveness, driving cost-effective stablecoin transactions while surpassing Ethereum’s total value locked.

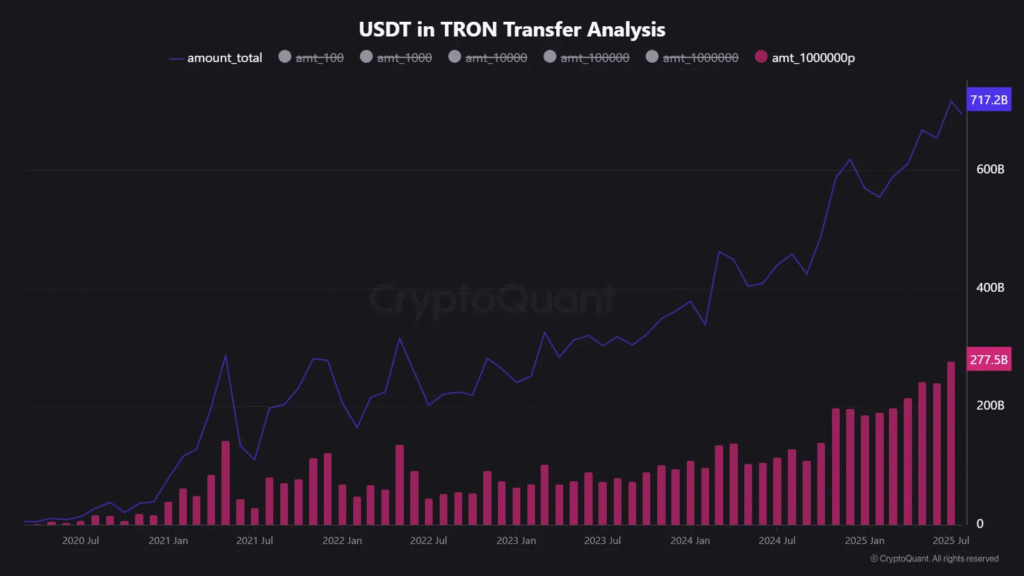

- USDT transfer volume on Tron hit $717.2 billion in July, with whale activity reaching $277.5 billion in monthly transactions.

Tron’s native token, TRX, is testing a critical price level as technical signals and on-chain activity shape short-term market direction. Bulls must defend key support to maintain control while the network undergoes major updates.

TRX Price Structure at Key Levels

TRX is currently trading at $0.338, with buyers and sellers closely monitoring defined supply and demand zones. Analyst @bullishbanter01 observed that resistance remains near $0.36–$0.37, while demand is concentrated around $0.321.

This structure creates a clear battleground for momentum. A clean fair value gap exists below the current price, raising the possibility of a liquidity sweep before any sustained rebound. Such a move could test market conviction at the $0.321 support area.

For buyers to shift sentiment, reclaiming $0.351 is viewed as the immediate trigger. Without this move, sellers could continue exerting pressure, leaving bulls to defend against further downside risk.

Network Fee Reduction Strengthens Use Case

Beyond market structure, Tron recently implemented a 60% network fee reduction following community approval. This change was designed to make the chain more competitive and enhance efficiency for stablecoin transfers.

Ethereum remains a major hub for decentralized finance, yet its higher transaction costs often limit smaller transfers. Tron’s fee reduction creates a cost-friendly environment for retail and institutional players seeking faster settlements.

The network now has a total TVL (total value locked) of $80.97 billion, which exceeds Ethereum’s $73.8 billion. This reflects not only the adoption motivated by lower fees and operational efficiency, but also the stablecoin-based activity.

Stablecoin Activity Reaches Record Levels

Stablecoin transfers continue to dominate usage on Tron. Analyst @maartunn reported that whale USDT transfers on the network reached $277.5 billion in July. These transactions represent single transfers of over one million USDT.

Overall USDT transfer volume surged to $717.2 billion during the same month, nearly double the $429.3 billion recorded in July 2024. This figure marks the highest monthly volume ever processed on the chain.

Stablecoins allow quick, low-cost transfers of large sums without volatility, making them the preferred choice for traders and institutions. With Tron hosting this activity at scale, its role in global digital liquidity continues to expand alongside TRX’s technical narrative.